Space is an Uncorrelated Investment Sector

By Meagan Murphy Crawford

The Space Industry is Not Strongly Correlated to Major Market Indices or Alternative Asset Classes

Over the last two decades, “NewSpace” has emerged as a burgeoning alternative investment sector, with dozens of venture capital firms investing in this rapidly growing industry. The space industry has also started being represented in other asset classes such as private equity, debt, and public markets. However, this new sector is not yet well understood by the capital allocators that invest in venture capital and other asset classes, due to the nascent nature of the industry and the relatively small sample size of public companies.

The research summarized here was conducted to help such allocators understand how this new alternative investment sector relates to other investment opportunities. Spoiler alert – Space is not correlated with any investment sector tested and did not have a single year of negative growth during the testing period. But don’t take my word for it, the data speaks for itself.

What is NewSpace?

Space is a rapidly evolving sector of the global economy. The aerospace industry has been active since the 1960s when NASA turned to private companies to manufacture elements of its space program. Large aeronautics companies such as Boeing, Lockheed Martin, Raytheon, and many others expanded their “aero” programs to include “space” technologies for both civil and defense customers, creating the “aerospace” industry.

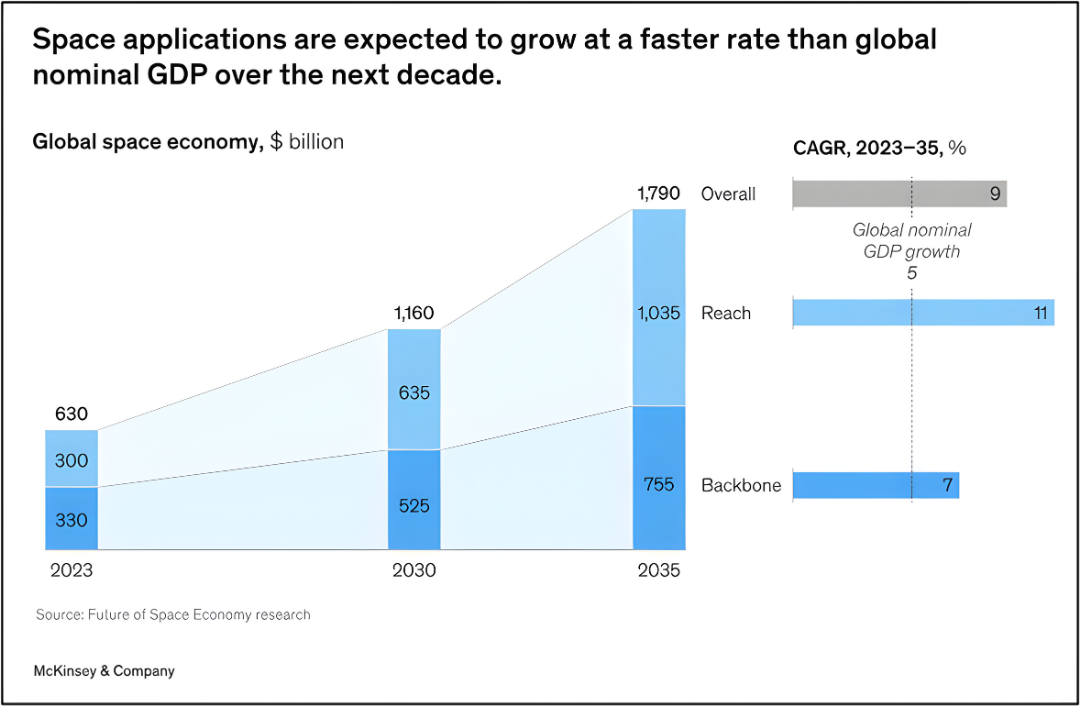

However, over the last two decades, a new type of space industry has begun to emerge, characterized by customer focus, new product development approaches, and new business models. This ‘NewSpace’ revolution has contributed to significant industry growth as new entrants develop novel business models that utilize the space environment to create profit. According to McKinsey & Company, the space industry is predicted to grow from $630 Billion in 2023 to over $1.8 Trillion by 2035.

Fig. 1 Space Applications are Expect to Grow at a Faster Rate than Global Nominal GDP Over the Next Decade

While most investors will be familiar with Elon Musk’s SpaceX, and maybe Jeff Bezos’ Blue Origin, very few will realize that there are more than 160 other launch companies competing in this market. Or, that there are more than 5,000 startup companies that are building the satellites and other technologies that drive demand for launch services. Ahead of a potential SpaceX IPO in 2026, many investors may be wondering if the space industry is mature enough to be a part of their portfolio.

This new space industry has been largely driven by private investment, as opposed to the civil and defense sponsorship that was, historically, the most common source of capital in the aerospace industry. In fact, Bryce reports that among start-up space ventures, “venture capital firms account for nearly three-quarters of investors in 2022 and, along with corporations and angel investors, makeup over 90% of investors.” From the year 2000 until 2021, the total private investment in the space industry was $46.5 Billion, of which $27.1 Billion was from venture capital firms.

SpaceFund regularly conducts market research to help institutional investors better understand this high-potential space investment sector, and in 2024 published a peer-reviewed journal article that showed that the space industry is not correlated to other investment sectors. The findings of this research suggest that space is consistently weakly correlated to every asset class and investment sector tested in the study. This weak correlation, coupled with the industry’s consistent growth over the period tested, suggests that the space industry could offer valuable diversification and hedging opportunities for institutional investors.

Space is a Diversifier

Using Year-Over-Year growth as a standard measure from 2005 to 2022, SpaceFund conducted a Pearson correlation calculation between two space datasets and eight chosen major market and alternative asset indices, which include both asset classes (stocks, real estate, hedge funds) and sector-specific investments (oil, gold, Bitcoin):

Global Stock Index - S&P 1200

Global Stock Index - MSCI

Global Oil Index - S&P

Crude Oil price per Barrel

All REITs Index by NAREIT

Eurekahedge Hedge Fund Index

Price of Bitcoin (BTC in USD)

Gold Return on Investment

The results of this test were stunning and backed up SpaceFund’s long-term hypothesis that investing in space can help diversify any portfolio.

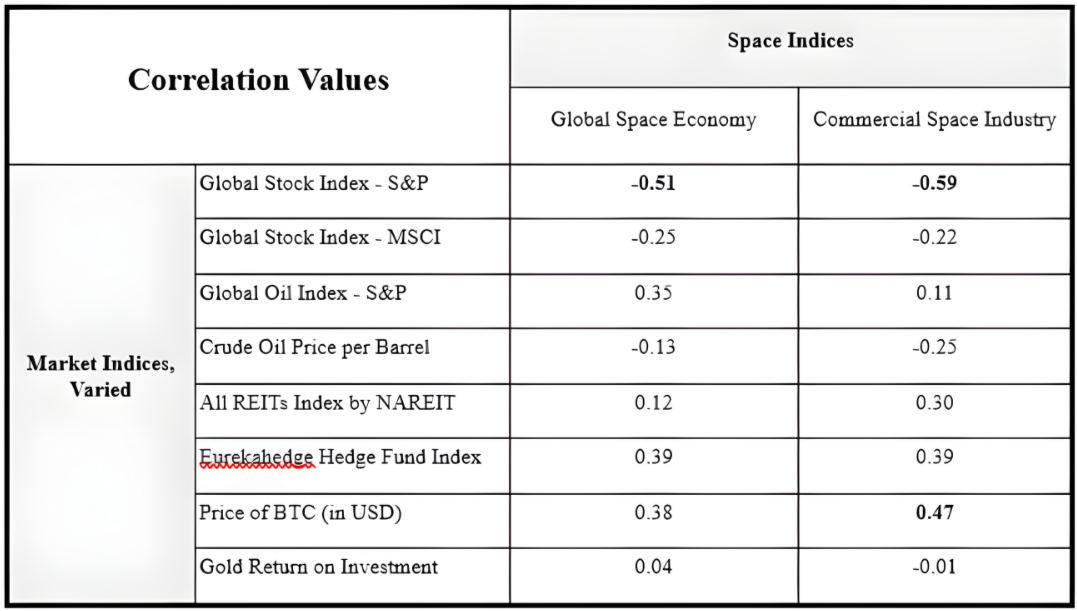

Fig. 2 Results of Correlation Calculations Between Two Space Datasets and Eight Major Market and

Alternative Asset Class Indices

The results of this research clearly show that the space industry is weakly correlated to most of the global market and alternative asset class indices to which it was compared, except for the moderate negative correlation seen between the S&P Global and both space indices and the moderate positive correlation between the price of Bitcoin and the Commercial Space Industry (in bold in the chart above). There are no correlation coefficients that are within the strong range, and most are well within the negligible or weak ranges. This data shows that whatever the source of financial capital (venture capital, private equity, debt, public markets, etc.), dedicated space portfolios within those asset classes may compete more effectively than the other investment sectors studied in this research.

The moderate negative correlations between the S&P Global (-0.59 for the Global Space Economy and -0.51 for the Commercial Space Industry) only further prove that the space industry is not affected by global market drivers and tends to move opposite to the S&P Global. The authors hypothesize that this is due to the insulated nature of the industry which has continued to show positive growth even during volatile market conditions.

There is also a moderate positive correlation between the price of Bitcoin and the Commercial Space Industry (0.47). We hypothesize that this moderate correlation has been caused by the rapid increase in value in both asset classes during the period tested. It’s also important to mention that BTC pricing data only became available in 2011 after the advent of the new asset class of cryptocurrencies, so the comparison period was significantly shorter than with the other datasets. As both industries continue to mature, this will need to be tested again in the future to determine if the two datasets continue to show a moderate correlation.

Interestingly, both space datasets show the weakest correlations to the Gold Return on Investment Index (0.04 for the Global Space Economy and -0.01 for the Commercial Space Industry). There is also a weakly negative correlation between the Crude Oil Price per Barrel and both datasets (-0.13 for the Global Space Economy and -0.25 for the Commercial Space Industry). Both assets (Gold and Oil) show significant volatility over the period tested. When compared to the stable growth of the space industry data, the volatility of the other industries may be the driver of these weak correlations

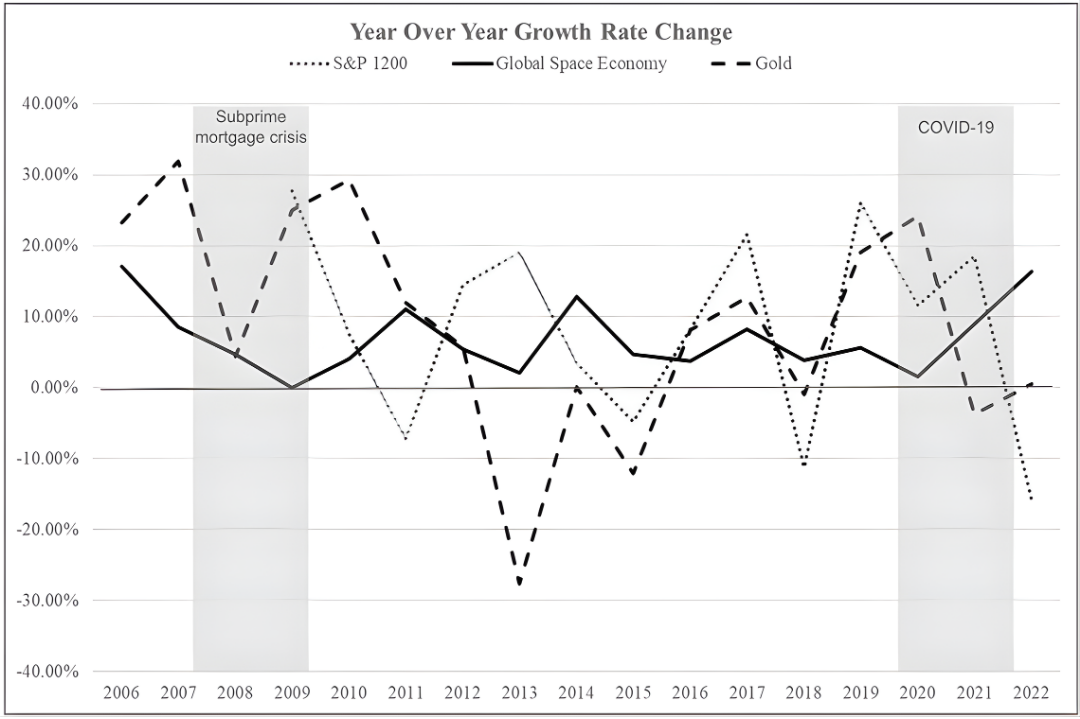

The space industry is the only dataset tested that did not have a negative year of growth between 2005 and 2022. It appears that when a Black Swan event like COVID-19 or the subprime mortgage crisis of 2008-2009 happens, the space industry may be minimally affected.

Space is a Hedge

The space industry is the only dataset tested that did not have a negative year of growth between 2005 and 2022. It appears that when a Black Swan event like COVID-19 or the subprime mortgage crisis of 2008-2009 happens, the space industry may only be minimally affected. In Figure 2 (below), the Global Space Economy is represented by a solid black line, showing that the industry has not had a year of negative growth during the period tested. In this chart we compare the Global Space Economy with the S&P 1200 as well as the Gold Return on Investment Index, as these are the two indices with the most (S&P 1200) and least (Gold) correlation from the study’s results.

Fig. 3: Year Over Year Growth Rate Chart Comparing the Global Space Economy, the S&P 1200, and the

Gold Return on Investment Index.

This consistent positive growth in the space industry may be attributable to several factors that are unique to this economic sector. SpaceFund believes that the following industry drivers may have impacted this distinctive growth profile:

The Global Space Economy, and to a degree, the Commercial Space Industry, are largely driven by the world’s largest space customer, the US government. According to some reports, the USG space budget accounts for at least 20% of the overall Global Space Economy, providing a steady stream of reliable income to these companies that are not tied to wider market conditions.

The primary drivers of the rapid increase in objects being launched into space are the drastic reduction in launch costs due to SpaceX and other private launch providers, and the reduction in the size and weight of spacecraft (following the expectations of Moore’s Law). These forces continue to put downward pressure on price and size, creating more economic opportunity, regardless of broader market conditions.

During the COVID-19 pandemic, most space companies around the world were given the ‘essential’ designation required to continue operations, even as other businesses were forced to close. This likely helped the industry weather the storm as operations were not severely hindered, even if supply chain hiccups caused production delays in some cases.

What This Means for Asset Allocators

Simply put: You need a space strategy.

The space industry may be unique in its ability to offer both downside protection and a lack of correlation to other investment opportunities. As capital allocators continue to search for opportunities to diversify their portfolios while having the opportunity to realize outsized returns, the space industry should be considered as a potential investment sector. While the public market investment opportunities for this industry are still minimal, there are several private market investment options, including the space-focused portfolio management strategies of several emerging private equity and venture capital firms, such as SpaceFund.

SpaceFund pioneered space-focused venture capital with its founding in 2018, and SpaceFund I began investing in 2019. As of this writing (January 2026), SpaceFund I now has a VC industry leading TVPI of 3.86 and has two exits under its’ belt (Made in Space was acquired by Red Wire in 2020 and Voyager Technologies IPO’d in June of 2025). SpaceFund I also recently signed the necessary documents consenting to the proposed Skyloom merger with IonQ, Inc. While the transaction has not been finalized, we are cautiously optimistic that this will be our third exit in Q1 2026. SpaceFund II (vintage 2021) is following in SpaceFund I’s footsteps and already producing phenomenal results. SpaceFund II also participated in the Voyager Technologies IPO this summer. Both funds will soon be tracking DPI, which is very rare for VC funds this young. Of the 21 companies we invested in across both funds, we have had only one failure. In an industry (venture capital) that expects a 90% failure rate, SpaceFund can currently boast a 95% success rate.

Based on the research above, the results of our first two funds, our proven ability to pick great companies, and our hands-on management of those companies’ growth through active board roles, SpaceFund is currently raising its’ third fund. The NewSpace revolution is finally mature enough, well understood enough, and proven enough to make a great diversifier and hedge for any institutional portfolio. Please reach out if you would like to add the most exciting investment sector of this generation to your portfolio.

The full journal publication which includes the detailed research results can be found online at SpaceFund.com/Intelligence, along with an interactive graph of all the data collated in the study, and several other market intelligence reports that can help asset managers better understand the space investment landscape.

Meagan Murphy Crawford

Founder and Managing Partner

SpaceFund

SpaceFund is an early-stage venture capital investment fund, dedicated to supporting the most promising entrepreneurs in the most exciting high-growth industry of this century.

Utilizing our unique insight and access to this rapidly growing field, SpaceFund is creating a diversified portfolio of the most promising startups in the new space ecosystem.

Technologists, investors, and business builders from the space and finance industries have united to provide the right expertise to create a space-focused venture capital firm.

SpaceFund performs ongoing research on the entire space startup ecosystem, with a special focus on market size, creation of new markets, financing, and exits.