The 2026 AI Investor's Playbook: Where Alpha Actually Lives

By Chuck Stormon

A year ago, many investors made a straightforward play in AI investing: buy the infrastructure. The market then digested what happened when that infrastructure spending hit unprecedented scale. Today, data center capital expenditures are projected to reach $5.2 trillion by 2030. That's not a typo. The buildout is so massive that the investment decisions of a handful of companies are now macro-economic drivers.

But here's the catch: this massive infrastructure investment is front-loaded while revenues from AI remain back-loaded. Companies are leveraging up (borrowing) to bridge that gap, which makes the entire system more vulnerable to shocks. It's infrastructure debt at a scale we haven't seen before, which means higher risk that may not match the rewards to be gained.

The real question investors face in 2026 isn't whether AI will transform industries, it's who will capture the value. With four decades in the field, I can tell you this, “Now that the foundations are poured, what matters most is what gets built on top of them.”

The Infrastructure Reality Check

Power is the New Bottleneck

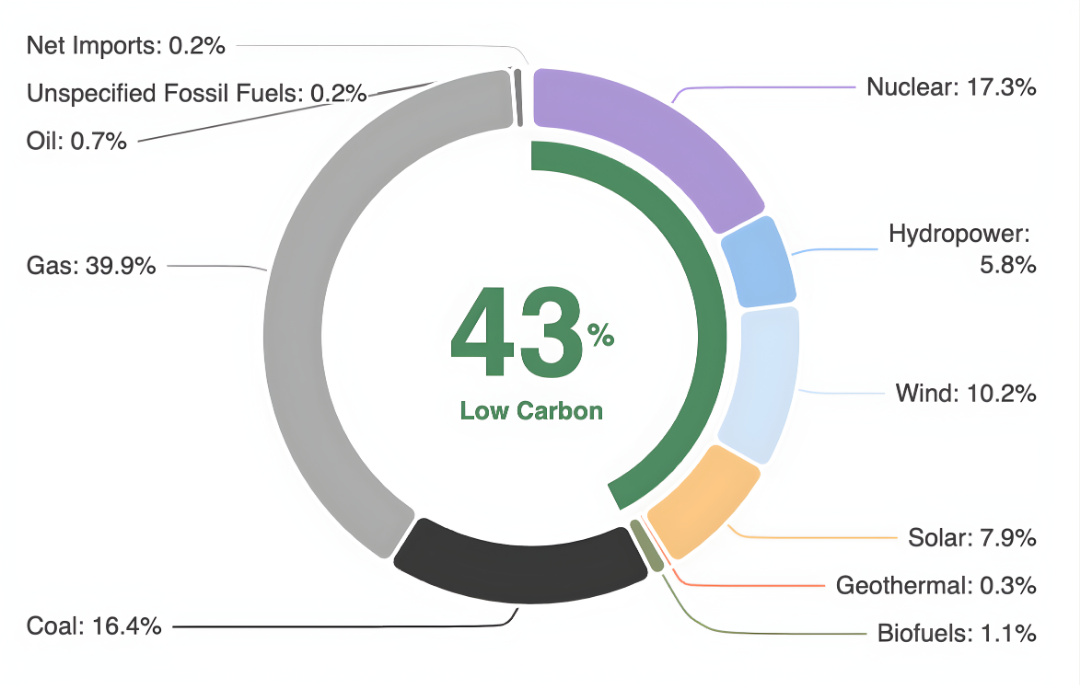

Energy has become the critical constraint in the mad rush to build out data centers. Advanced reasoning models like GPT-5 consume between 2.5 and 20 times the energy per prompt compared to the previous generation of models. Data centers are being built wherever cheap land, abundant power and water for cooling are available. Natural gas, which accounts for an essential 40% of U.S. electricity generation, grew fast enough to handle the growth in demand in 2025. There continue to be real opportunities in natural gas infrastructure, pipelines, and producers. Solar grew 27% while solar and wind power combined exceeded coal in the production of electricity for the first time in 2025. Both solar and wind’s reliance on natural gas lessened as batteries are increasingly able to provide stable grid power around the clock. All together, non-fossil, non-carbon sources of electricity make up 43% of US generation. Big bets are being placed on small modular reactors and fusion power, but these are very unlikely to be realized in 2026. Power generation continues to get greener, accelerated by this spike in demand. The easy bets in infrastructure are played out. Investor discernment is key in 2026.

The Semiconductor Supercycle

AI semiconductors remain in a supercycle, with Nvidia crossing $5 trillion valuation in 2025, but the landscape is fragmenting. Wall Street analysts expect Nvidia’s revenues to reach $275 billion per year by 2027. I expect Nvidia to reach $400 billion in annual revenue by 2030, driven primarily by data center demand. Since power is the limiter for data centers, increases in performance per watt is a critical driver for replacing older AI chips every 3 to 5 years. This powerful driver will continue to power investor returns in AI semiconductor plays through 2030.

With LLMs scaling rapidly, semiconductor spend in data centers is expected to exceed $500 billion by 2030, representing more than 50% of the entire semiconductor industry. The shift from general-purpose chips to application-specific semiconductors is accelerating, demanding continuous investment in specialized architectures. AMD, Intel, AWS, Alphabet, Alibaba, IBM, Huawei, Groq, and Google all have AI datacenter chips that compete with NVIDIA’s flagship offerings, so expect more deals in 2026 like NVIDIA’s licensing (and acquihire) of Groq’s architecture.

The AI tsunami will bypass most semiconductor companies. Nearly all data center semiconductor revenues are concentrated among nine companies: Nvidia, TSMC, Broadcom, Samsung, AMD, Intel, Micron, SK hynix, and Marvell. Some of the smaller companies with significant data center exposure include Astera, Credo, MACOM, ASPEED, Alchip, GUC, and SiTime. Look for significant acquisitions over the next half decade as giants like Amazon, Microsoft, Google, Meta, Nvidia and Broadcom bid to acquire smaller firms like AMD, Intel, Marvell, Mediatek, Astera, and others to secure their AI leadership.

In the second half of this decade, AI inference is quietly shifting toward edge devices like smartphones, robotics and internet of things devices. The drivers are lower latency, better privacy, and reduced bandwidth costs. On-device AI will unlock the next wave of value in consumer hardware. Companies that crack efficient edge inference will own a massive market that is less dependent upon billion-dollar investments in gigawatt data centers. Top players in mobile AI are Apple, Huawei, MediaTech, Qualcomm and Samsung. Edge devices like drones, IoT, cameras, robotics and automotive are getting new AI chips like NVIDIA’s Jetson Orin, Google’s Edge TPU, Intel’s Movidius Myriad, and Hailo’s Hailo-8.

Beware Circular Deals

In September 2025, OpenAI disclosed a $300 billion agreement with Oracle to buy computing power over about five years starting in 2027. To fulfill that commitment, Oracle must buy massive quantities of Nvidia chips. That same month, Nvidia announced it would invest up to $100 billion cash in OpenAI while OpenAI committed to deploying/leasing at least 10 gigawatts of Nvidia systems. This lets OpenAI spread costs over the useful life of the GPUs (i.e. 3 to 5 years). NVIDIA uses its ability to generate relatively low cost investor capital to get a stake in OpenAI. Elegant, right? Meanwhile, Amazon invested $8 billion in Anthropic, which committed to using AWS as its primary cloud provider and training partner, specifically on Amazon's Trainium and Inferentia chips. I call these arrangements “circular deals” because of the closed loops where capital flows out as equity investment linked to potential returns as multi-billion dollar revenues as purchase commitments are realized over time. So why do I say, “Beware”?

There are two problems here to be aware of: 1) revenue quality issues, and 2) hidden correlations. To illustrate a revenue quality issue: Oracle’s forecast drove the stock to record highs until the market priced in the fact that one of their biggest customers, OpenAI, couldn’t necessarily underwrite such a large purchase of Oracle’s services. How real is a forecast when much of the forecasted revenue is recycled capital?

Hidden correlations are a different type of risk. If AI startups (e.g. OpenAI, Anthropic) fail, infrastructure providers (e.g. Nvidia, Oracle, Microsoft, Amazon, Google) lose both equity and revenue simultaneously. This creates concentrated, correlated exposure disguised as separate bets. The correlation is perfect and negative in a downturn.

There are historical parallels worth noting. It’s taken Cisco (the Nvidia of the dot com era) 25 years to recover from the burst of the dot com bubble. In the late 1990’s, about 10% of Cisco’s revenue was tied up in circular deals where Cisco financed its customers to purchase its products. When the music stopped, Cisco’s stock lost almost 90% of its value between March 2000 and October 2002. Analysts were predicting this trouble as early as 1997. However, if you heeded those warnings in 1997, you would have missed a doubling of the market prior to the crash. That’s the mistake that investors moving to cash too early always make: trying to time the market is a reliable way to lose money and opportunity.

Here are some crucial differences in the current situation compared to past bubbles.

Nvidia’s market cap at roughly 38 times forward earnings is modest compared to Cisco’s peak of 200 times.

The GPUs, data centers, fiber optics sold in these deals are being built and deployed against real demand. ChatGPT has 700 million weekly active users and Claude powers real enterprise applications.

The demand for AI capabilities is genuine and broad based, with customers that include cash-loaded companies that won't collapse like the fragile dot-com startups that brought down Cisco.

Nvidia's investment thesis for OpenAI will prove correct if OpenAI becomes a multi-trillion-dollar hyperscale company. Gaining platform lock-in from OpenAI has real value for Nvidia. Once they train models on specific chip sets and integrate with specific cloud services, switching costs are enormous.

My advice to investors and capital allocators is to price the risks into their investment theses and beware over-exposure by missing hidden correlations. Diversify your bets. Don't treat infrastructure providers and foundation model providers as independent positions now that they're one leveraged bet with circular cash flows. Many portfolios own Nvidia and OpenAI and have a lot of exposure through funds or secondary markets. Recognize the extent to which you have correlated risk, not diversification, with these positions.

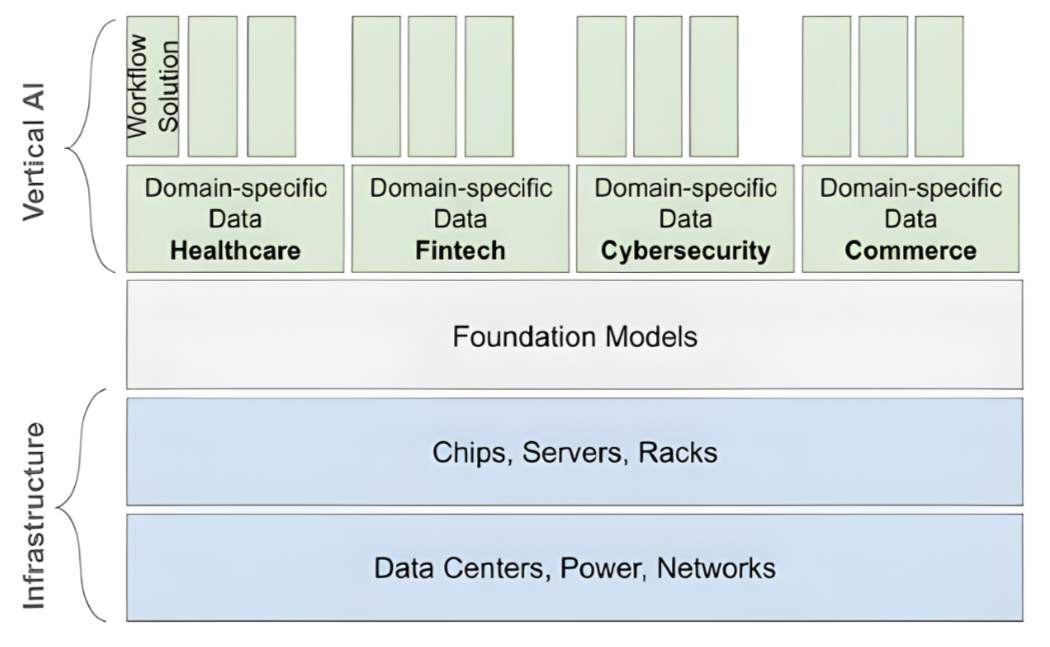

The Future of AI is Vertical

The biggest shift in 2026: value creation is moving from foundation models to application builders. Foundation models are becoming commoditized. Competition continues to drive rapid improvement across all the foundation models as OpenAI, Anthropic, Google, and others continually strive to achieve benchmark supremacy. As leadership shifts back and forth between the players, user growth rates shift as well. There is still a lot of growth potential for foundation models as absolute adoption is still relatively low. During the next two years I expect the market growth to slow as an equilibrium is eventually reached. Therefore, investors need to realized that alpha actually lives in vertical AI and agentic systems that solve specific, high-value problems. It is here that returns will be most robust over the next five years.

Vertical AI Hits Its Stride

Vertical AI companies, those purpose-built for specific industries, are reaching 80% of the average contract value of traditional enterprise SaaS while growing at 400% year-over-year. They're automating complex, language-based workflows in insurance, legal, healthcare, and finance that were untouchable before now. The economic impact could reach $344 billion annually across these major sectors. Winners in vertical AI share three traits: they start with a compelling wedge that relieves an acute pain point, they build defensibility through domain expertise and data moats, and they deliver immediate return on investment for their customers rather than incremental improvements. This is where alpha has migrated to and is living today.

Concrete examples of Vertical AI:

AI driving customer engagement across automotive retail (e.g. Impel.ai),

AI that predicts which lender a customer should use (e.g. SelectFi.com),

AI agents optimizing marketing spend (e.g. Albert.ai),

AI nudging subscribers to pay their bills on time (e.g. KredosAI.com),

Predictive analytics in supply chains (e.g. FourKites.com),

AI that monitors your metabolism and helps with weight loss (e.g. Signos.com) and

AI that helps companies protect their brands against narrative attacks (e.g. Blackbird.ai).

These aren't science projects, they're real companies generating real revenue and real profits. Venture investors have caught on, with strong interest in early-stage vertical applications in fintech, cybersecurity, healthcare, and commerce.

Agentic AI: Promising but Early

Autonomous AI agents that plan and execute complex tasks are generating enormous hype, suggesting they exceed human-level performance on certain tasks now, with massive replacement of human work as early as mid-2026. The upsides of cost savings, better decisions, 24/7 operation driven by AI are real. But temper expectations and don’t believe the nonsense of AI replacement theory. I’ve written articles about this topic.

Early agentic AI implementations had mixed results at best. The technology isn't mature enough for mass adoption in most applications. There is a lot of potential in agentic AI, but the path to reliability will be longer than the hype suggests. The competitive landscape is global, and disruptive innovation could come from unexpected players. Focus investing on teams with vertical domain expertise who understand the workflows they're automating, not just the models they're deploying.

Market Dynamics: Boom, Not Bubble

The AI rally has legs and it's not irrational exuberance. Unlike the dot-com era, valuations are supported by actual earnings growth, strong profitability, and solid balance sheets. Over the past three years, forward P/E multiples for AI stocks have declined while EPS estimates have more than doubled. That's a boom, not a bubble. That said, three risks demand attention:

Concentration Risk: AI investment now impacts nearly 40% of the S&P 500's market cap, concentrated in a handful of mega-caps. History shows that extreme concentration often precedes corrections. This doesn't mean sell everything; rather it means that active management matters more than ever.

Overinvestment Risk: Competitive dynamics and the massive infrastructure spending it is pushing may exceed actual demand and revenues may take years to ramp up to sufficient levels to justify the investments being made. We've seen this movie before. Large-scale buildouts often result in overcapacity and someone ends up holding stranded assets. That’s a risk, not a certainty, as the AI boom is moving faster than others we’ve seen in the past.

Adoption Gap: Up to 95% of enterprise AI projects haven't delivered measurable financial returns yet. Corporate adoption is real but early-stage. Watch for durable usage embedded in workflows versus sporadic experimentation that won't translate to sustainable revenue.

The 2026 Playbook

Public Equities: Stay Overweight Tech, But Be Selective

Maintain overweight exposure to U.S. equities, particularly large-cap tech. The AI theme is broadening, Fed easing continues into 2026, and earnings remain strong. But this is an active management environment. You need to identify software winners, avoid business models headed for obsolescence, and focus on quality, value, and low-volatility factors to offset concentration risk.

Internationally: overweight Japan (strong nominal GDP growth, corporate capex, governance reforms), neutral on Europe (selective opportunities in financials, utilities, healthcare), and neutral overall on emerging markets. Supply chain rewiring creates opportunities in Mexico, Brazil, and Vietnam.

Fixed Income: Navigate Higher Inflation

Maintain tactical underweight to long-term U.S. Treasuries. High debt-service costs and price-sensitive buyers keep pushing up term premiums. Complement core fixed income with inflation hedges: real assets, commodities (natural gas and oil given AI power demands), and tactical exposure to gold and crypto.

Private credit continues its momentum, expected to surpass $5 trillion by 2029. Senior direct lending provides resilient returns, but asset managers are diversifying into asset-based finance and infrastructure debt. Credit markets are increasingly financing AI infrastructure itself. Key insight: this also creates hidden correlations between private credit investments and AI infrastructure.

Private Markets: Opportunistic Wins

Private equity offers idiosyncratic returns that are uncorrelated with public markets. Manager selection is crucial. Companies are staying private longer and achieving massive scale before IPO. The opportunity in 2026 is concentrated in platform technologies and applications, agentic AI systems, vertical industry applications, and specialized infrastructure.

Venture capital has shifted from broad AI exposure to focused application-specific solutions in healthcare, cybersecurity, fintech and commerce that drive actual revenue. Proven managers are getting the capital. AI accounted for over 60% of venture capital investment over the past year. That's not going to slow down, but it is getting more selective.

Policy: Regulation Gets Serious

AI red teaming and due diligence has evolved from ad hoc reviews to formalized governance frameworks. Key components include data quality and bias checks, proactive security and compliance audits, scalability verification, and cost-effectiveness analysis. Regulatory pressure is intensifying. The EU AI Act's transparency requirements kick in August 2026. Financial authorities globally are monitoring AI-related vulnerabilities, particularly third-party dependencies (concentration risk in cloud providers and foundation models) and potential for AI-driven market correlations.

What Comes Next

We're past the infrastructure land-grab phase. Value creation and alpha in 2026 center on companies that turn AI capabilities into profitable, defensible businesses. That requires surgical precision in allocation, treating AI as a diverse ecosystem, not a monolithic bet.

The investors who win this cycle will balance exposure to infrastructure giants with targeted investments in nimble, innovative application companies. They'll maintain valuation discipline, active management, and flexibility to rebalance as the landscape evolves. Most importantly, they'll focus on companies solving real problems with measurable ROI, not just impressive demos.

After watching AI hype cycles for over forty years, I can tell you that this moment feels different. The technology is real, the economics are compelling, and the scale is unprecedented. But that doesn't mean every investment works. Stay disciplined, stay selective, and remember two things: 1) in technology transitions this large, speculators will come and create bubble economics that result in corrections, but long term, the only play is to stay invested, and 2) the companies creating lasting value aren't always the ones that build the infrastructure, they're the ones that figure out what to do with it. I remain bullish on vertical AI as the best place to find alpha in 2026.

About the Author: Chuck Stormon has been a thought leader, researcher, entrepreneur, operator and investor in AI for 42 years and has seen many hype cycles and winters. He has built eight companies, including developing one of the first AI accelerator chips and many substantial vertical AI businesses. For the past dozen years, Chuck and his partners at StartFast Ventures have invested in high-growth vertical AI solutions startups producing top-decile results. chuck@startfastventures.com

Chuck Stormon

General Partner

StartFast Ventures

We back B2B SaaS founders from Charlotte to Phoenix to Buffalo and beyond.

How we help

StartFast is optimized to address challenges faced by startups outside major VC hubs.

Faster investment decision making

Access to trusted coinvestors

Extensive network of mentors/subject matter experts

Referrals to strategic partners and later stage investors