Italy is on Everyone’s Shortlist? Really?

By John Pavia

In 2025, Blackstone announced that it would invest $500 billion in Europe over the next decade. Apollo Global Management followed suit, dedicating $100 billion to Germany and the EU. Brookfield also announced multiple investments, including $10 billion and $23 billion respectively in Swedish and French AI infrastructure. Ares Management Corporation closed its sixth European direct lending fund at $20 billion – oversubscribed and 53% larger than its prior fund.

In Italy, KKR secured approval for its $24 billion acquisition of Telecom Italia’s fixed-line network, as well as a $13.8 billion increase in its stake in Enilive, the mobility division of Eni, Italy’s multinational energy company. Bain Capital also acquired a controlling stake in Namirial, provider of transaction management software, at a valuation of $1.3 billion. This all began in 2024 when Open AI signed an agreement with CDP Venture Capital (Italy’s sovereign fund) to co-invest in Italy’s most innovative technology companies.

What’s Going On?

Italy has become a hotspot for smart money over the last several years. As a result, in November 2025 Moody’s upgraded Italy’s credit rating, citing the country's consistent track record of political and policy stability. All major global credit rating agencies have upgraded Italy in the past year.

A major signal validating this shift is the reauthorization and expansion of the U.S. International Development Finance Corporation (“DFC”). The DFC is America’s international development bank, a federal agency that invests taxpayer dollars into companies, funds, and projects around the world via debt and equity investments.

In December 2025, the DFC was reauthorized along with several modifications: its total spending cap was raised from $60 billion to $205 billion; a new $5 billion revolving fund was created for equity investments; and restrictions on high-income countries were lifted. Most European countries are now eligible for DFC financing, including Italy.

How We View Italy

Italy has long been synonymous with quality, beauty, and excellence. The world recognizes Italian culture as being associated with these terms. In December 2025, UNESCO recognized Italian cuisine as an Intangible Cultural Heritage of Humanity, the first national cuisine to receive this award.

But what if we told you that the same three words – quality, beauty, and excellence – also apply to high-tech sectors like AI, quantum computing, industrial robotics, renewable energy, life sciences, aerospace, advanced manufacturing, and more? “Made in Italy” extends far beyond the postcard.

Italy’s Industrial Reality

Italy quietly supplies the world with some of the most complex products and services. Italian expertise primarily lives in narrow niches, such as advanced materials, industrial automation, specialized machinery, power electronics, medical devices, and aerospace subsystems, to name a few. The scale of Italy’s contribution to these sectors is easy to miss because it often exists inside another finished product.

More than 40% of the habitable modules of the International Space Station were manufactured in Italy. One of the largest shipyards in the United States is operated by an Italian company through its U.S. division. There are only three F-35 final assembly sites worldwide. One in the U.S., one in Italy, and one in Japan, with Italy being the only facility outside the U.S. with F-35B assembly capability.

The question is, how has a world-class industrial base stayed under the radar of global capital markets?

Historical Context

The answer is less about quality and more about structure and narrative. First, Italy’s best assets can be difficult to “see” through the typical investor lens. Many companies are not equity-backed and do not appear in the processes that generate consistent deal flow.

Second, the market is relationship-driven in a way that is easy to underestimate. Trust and reputation often gate access and influence how owners evaluate outside capital, making it difficult for foreign investors to build strong relationships with operators.

Third, Italy is an SME economy by design, comprising 99.9% of all Italian firms. The country is composed of dense networks of specialized companies, often family-owned, and optimized for exporting rather than creating global operating footprints.

High Potential and Compressed Valuations

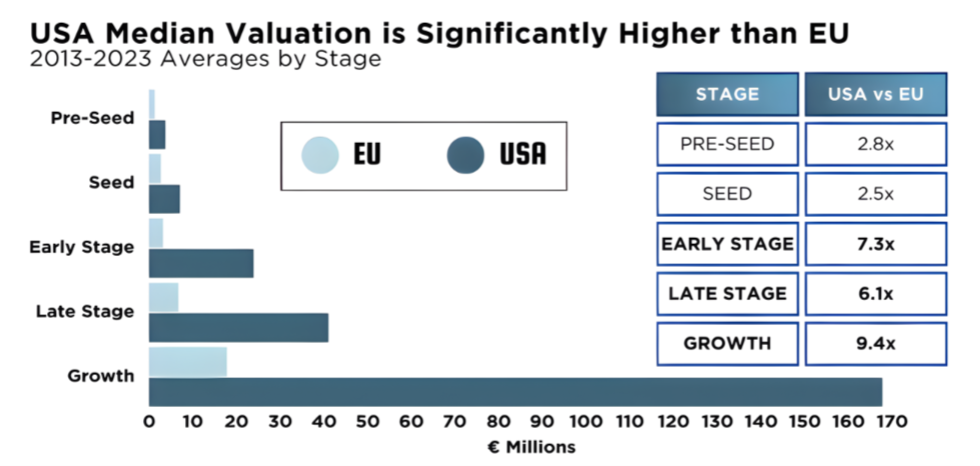

The result is that Italian businesses have relatively low valuations compared to U.S. multiples. Not because their technology is weaker, but because the ecosystem has historically produced fewer international platforms, fewer large exits, and a thinner late-stage capital stack.

Paradoxically, we believe this is why Italian operators are so strong. When scaling is harder, fundamentals matter more: process discipline, engineering rigor, product performance, efficiency, and resilience. Instead of scaling, Italian companies continuously improved their trade, making a lot out of very little. This is evidenced in all aspects of Italian culture.

What This Means for U.S. Investors

For U.S. investors, Italy can offer an enticing combination: world-class technology and talent, defensible niche leadership, and entry valuations that are substantially lower than comparable U.S. assets. In practical terms, there are multiple ways for U.S. investors to win in Italy:

Invest in funds and companies with strong fundamentals where scaling has been constrained by ecosystem factors rather than technology.

Partner with Italian investment managers who understand the local market but benefit from institutional capital and cross-border support.

Create measurable post-investment uplift by building U.S. go-to-market capacity.

Italy is not a market that rewards a purely transactional approach. Italian culture values trust and respect above all else. Any investment in Italy must be coupled with time, effort, and care that goes beyond capital.

Importantly, the “why now” is not that Italy suddenly became innovative. The “why now” is that more of Italy’s best founders, managers, and sponsors are building with an international mindset, while the capital stack remains thinner than in the U.S. and in the largest European markets. The issues that are endemic in the Italian investment community represent significant opportunities for U.S. investors – which is why smart money is now flowing towards Italy.

John Pavia

Managing Partner

Siena Lane Partners

Siena Lane Partners is an advisory practice that works with Italian sponsors and operating companies to develop and execute strategies to break into and thrive in the U.S. market. Siena Lane is the principal advisor to Italy’s sovereign fund, CDP Ventures. The firm provides market analysis, site selection, business development, and cross-border transactional advisory services. Our directors combine decades of experience in venture capital, private equity, economic development, and investment promotion, with deep personal and professional ties to Italy. Siena Lane is uniquely positioned to facilitate operational expansion, commercial growth, investment activities between the U.S. and Italy.