The Cayman Islands private funds surge: Understanding the drivers behind sustained growth

By Samantha Widmer

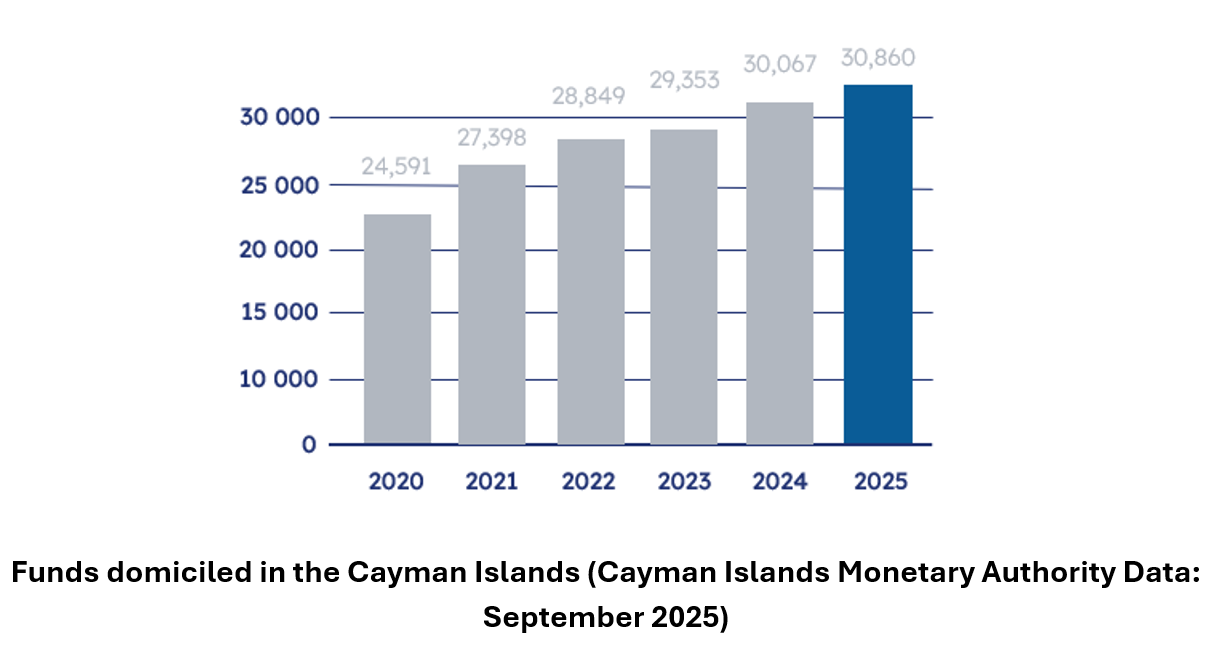

The Cayman Islands has experienced a remarkable transformation in its private funds sector over the past five years. Since the introduction of the Private Funds Act in 2020, private fund registrations have surged from 12,700 to more than 17,700, representing just under a 40% increase. As of September 2025, the Cayman Islands hosts almost 31,000 registered funds in total with over $8.5 trillion in assets under management, cementing its position as the world's premier offshore funds domicile.

This growth warrants closer attention. What factors are driving fund managers to choose Cayman for their private fund structures? And why has the jurisdiction maintained its dominance over the past five years?

The foundation: Tax neutrality and legal certainty

At the heart of Cayman's appeal lies its tax-neutral framework, a concept frequently misunderstood, but fundamental to cross-border investment. Tax neutrality simply means the jurisdiction does not impose an additional layer of taxation on top of what investors already owe in their home countries.

International investors remain fully liable to pay taxes on distributions and capital gains in their home jurisdictions. The Cayman Islands automatically reports fund investments to investors' respective tax authorities worldwide in accordance with the OECD Common Reporting Standard and the US Foreign Account Tax Compliance Act. In 2022, Cayman exchanged information on 550,000 accounts from 19,000 financial institutions, demonstrating its active commitment to transparency. Meanwhile, portfolio investments remain subject to tax in the countries where those investments are made.

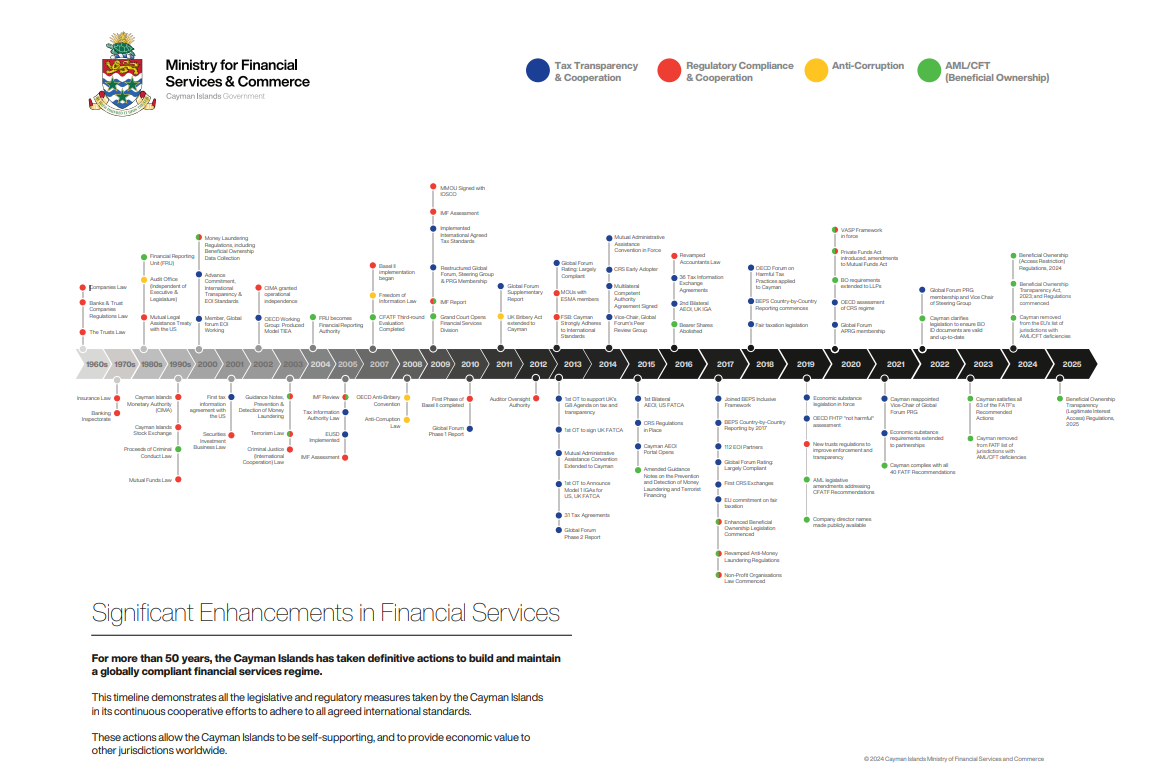

Cayman's commitment to transparency and financial crime prevention further strengthens its position as a trusted jurisdiction. The Cayman Islands holds leadership roles in the OECD's global forum on transparency and exchange of information for tax purposes and was one of 65 countries to receive the highest rating in the OECD's peer reviews. In recognition of its robust frameworks, the jurisdiction was appointed as one of the first two guest members under the Financial Action Task Force's Regional Bodies' Guest Initiative to participate in FATF meetings and working groups during 2024/25. The Cayman Islands has also established the Office for Strategic Action on Illicit Finance (OSAIF), a centralised authority that coordinates the jurisdiction's anti-money laundering and counter-terrorist financing efforts in alignment with international standards.

For fund managers, Cayman’s tax neutrality supports efficient access to global capital markets. It allows international investors to participate in global funds without incurring unintended tax liabilities or complexities that dual locations may bring. Cayman provides managers, particularly those based in the US, with a simple, well-tested vehicle for pooling international capital. This clarity and efficiency have made Cayman the preferred choice for fund managers seeking to attract a diversified investor base.

Cayman’s legal system, based on English common law, reinforces investor confidence through its strong precedents, modern legislation, and respected judiciary. The courts operate efficiently with an investor- and creditor-friendly approach and appeals ultimately go to the Privy Council in London. Many lawyers who specialise in Cayman funds come from top international firms, and the Grand Court’s Financial Services Division specialises in complex financial and commercial cases. Together, tax neutrality and legal certainty underpin Cayman’s global reputation.

According to the US Securities and Exchange Commission's private funds statistics, the Cayman Islands accounts for around 32% of the net assets of US private funds, far ahead of other competing jurisdictions. For qualifying hedge funds specifically, more than half (54%) of all net assets reported to the SEC are managed by Cayman-domiciled funds. These figures underscore Cayman's entrenched position as the preferred offshore jurisdiction for US fund managers seeking to attract international capital.

The Private Funds Act: Regulatory evolution supporting growth

Cayman’s success is also the product of thoughtful regulatory evolution. The introduction of the Private Funds Act in 2020, followed by subsequent enhancements, created a comprehensive system of oversight for private funds. The legislation established mandatory registration with the Cayman Islands Monetary Authority (CIMA), required annual audits, and formalised independent oversight functions for valuation, cash monitoring, and safekeeping of assets.

These measures codified practices that many sophisticated managers were already following and aligned Cayman with global regulatory standards. Rather than discouraging growth, they have strengthened investor confidence by ensuring a consistent and transparent framework. Institutional investors, including pension funds, sovereign wealth funds, and insurance companies, increasingly view Cayman’s regulatory system as a mark of credibility.

Cayman’s approach remains pragmatic and commercially balanced. Its regulatory framework protects investors and upholds international standards while allowing sufficient flexibility for fund managers to operate efficiently. This balance of strong governance and practical implementation has made Cayman the jurisdiction of choice for managers seeking both stability and speed to market.

Private credit: the primary growth engine

Private credit has emerged as a dominant force driving private fund formations in Cayman. This growth reflects fundamental shifts in the global financial system following the 2008 financial crisis. Stricter banking regulations have limited banks' capacity and willingness to lend, particularly to middle-market companies. Private credit funds have stepped into this financing gap, offering customised loan structures with faster execution than traditional syndicated loans or public markets.

Cayman has been a central platform for this growth. Its fund structures accommodate both open- and closed-ended formats, enabling managers to tailor liquidity and governance provisions to specific investment strategies. The jurisdiction’s familiarity with global investors, efficient registration processes, and trusted reputation all contribute to its continued dominance in this space.

Although market momentum may moderate as interest rate cycles evolve, the fundamental drivers of private credit remain intact. Demand for private financing continues to expand, and Cayman’s adaptable framework ensures it remains the domicile of choice for managers pursuing these opportunities.

Private equity's continued evolution

Private equity continues to be a cornerstone of the Cayman funds sector. While fundraising conditions have become more challenging, the jurisdiction's flexibility in accommodating complex fund structures has proven particularly valuable as private equity managers adapt to changing market conditions.

The emergence of continuation funds and secondary market strategies exemplifies this innovation. These vehicles allow managers to extend the life of legacy assets, provide liquidity to existing investors, and inject fresh capital, often requiring specialised "hybrid" liquidity and financing structures that differ from traditional master-feeder setups. Cayman's flexible legal framework and experienced service provider ecosystem make it particularly well-suited to support these evolving structures.

Cayman’s legislation also allows fund documentation to align closely with onshore requirements, ensuring consistency for global investors. This ability to replicate or integrate with onshore fund terms gives managers and investors confidence that Cayman structures will operate seamlessly alongside their domestic arrangements.

Supported by an extensive network of experienced legal, administrative, and audit professionals, the jurisdiction provides the expertise needed to design and operate increasingly sophisticated private equity platforms. As Cayman hosts more funds than any other offshore jurisdiction, it is also home to some of the most experienced funds professionals in the world. The sophistication of Cayman’s financial services industry attracts experts with a depth of knowledge continues to attract managers who value both innovation and reliability in their fund domicile.

Hedge Funds: A Resurgence Built on Liquidity

After several years of subdued inflows, hedge funds are once again experiencing a resurgence. As of mid-2025, the Cayman Islands hosts more than 75% of the world's offshore hedge funds and nearly half of the industry's estimated $1.1 trillion in assets under management.

Performance has driven this resurgence. According to Citco, hedge funds delivered their highest annual returns since 2020, achieving a weighted average return of 15.7% in 2024, with around 80% of funds posting positive returns in recent months. In a financial environment where many private market strategies tie up capital for extended periods, hedge funds offer flexibility that appeals to a wide range of institutional investors. Cayman’s efficient structures, clear governance framework, and regulatory certainty enable these funds to launch and operate quickly, often within weeks.

The jurisdiction’s reputation for reliability and consistency continues to attract managers seeking to combine agility with transparency. Hedge funds established in Cayman benefit from both the jurisdiction’s operational efficiency and the credibility associated with its mature financial infrastructure.

Family Offices: Sophisticated Capital Seeking Institutional Infrastructure

The increasing sophistication of family offices represents another key growth driver for Cayman's private funds sector. The number of single-family offices worldwide has risen sharply, and their collective assets under management is now around $5 trillion. These entities are increasingly allocating capital to private markets, seeking access to high-quality investments in private equity, private credit, and infrastructure.

Cayman’s reputation, legal certainty, and efficient fund structures make it a natural home for this growing segment. Family offices require the same level of professionalism and governance as institutional investors, and Cayman provides that through its network of experienced service providers. The jurisdiction’s expertise in establishing “access funds” has also enabled high-net-worth investors to participate in institutional-grade opportunities by pooling capital efficiently.

Regulatory attitudes toward access funds have also shifted favourably. While previous SEC administrations sought to limit retail exposure to alternatives, the current administration has encouraged greater access, citing the significant wealth generated in the sector. Cayman’s efficient and well-understood structures are positioned to facilitate continued inflows from family offices and private wealth managers worldwide.

Time-to-market: Speed as a competitive advantage

In an industry where timing can determine success or failure, Cayman's ability to launch funds rapidly represents a significant advantage. With CIMA's online REEFS portal, many funds can be registered and launched within weeks, provided service providers are aligned, and documentation is in order.

This speed stems from several factors: streamlined regulatory processes, experienced service providers who understand CIMA's requirements, standardised documentation approaches, and regulatory pragmatism that balances investor protection with commercial efficiency. For fund managers under pressure to deploy capital or capture market opportunities, these advantages are often decisive in domicile selection.

Looking ahead: Sustainable growth

The factors driving private fund growth in Cayman appear durable rather than cyclical. Private funds are growing at approximately 5% annually, with continued diversification into private capital, ESG strategies, and virtual assets expected. The jurisdiction is well-positioned to benefit from several emerging trends.

First, increased fund flows from emerging and growth markets including Brazil, the UAE, India, China, and Japan are creating new sources of capital seeking stable, internationally recognised structures. Japanese institutional investors alone have over $645 billion invested overseas, with approximately 80% flowing into Cayman-domiciled funds.

Second, the growing interest in virtual asset strategies and fund tokenisation positions Cayman to capture innovative fund structures. The jurisdiction is already home to approximately 63% of crypto and digital-asset hedge funds according to research published by the Alternative Investment Management Association (AIMA) and PwC, and a bespoke regulatory framework for tokenised funds is under development.

Third, the retailisation of alternative investments promises to expand the addressable market significantly. As alternatives reach broader markets beyond traditional institutional investors, Cayman's efficient structures and experienced service providers position the jurisdiction to capture a substantial share of this growth.

Conclusion: A foundation built on fundamentals

The substantial increase in private funds registered in the Cayman Islands reflects more than favourable regulation or tax treatment. It stems from a comprehensive value proposition encompassing legal certainty under English common law, regulatory credibility backed by international standards, operational efficiency enabled by experienced service providers, structural flexibility accommodating diverse strategies and investor bases, and tax neutrality that enables global capital flows.

As fund managers navigate an increasingly complex global landscape characterised by geopolitical uncertainty, regulatory harmonisation pressures, and rapid technological change, Cayman's ability to balance innovation with compliance, flexibility with governance, and commercial pragmatism with international standards positions the jurisdiction to maintain its leadership in the private funds sector for years to come.

Samantha Widmer

Associate Director of Funds & Capital Markets

Cayman Finance

Cayman Finance is a public-private partnership and the leading industry association representing the Cayman Islands’ financial services sector. Its mission is to protect, promote, develop, and grow the jurisdiction’s financial services industry through strategic engagement with domestic and international stakeholders.