The Case for Alternative Investments in Wealth Management

By Greg Poapst

Independent registered investment advisors (RIAs) and small family offices in the U.S. face growing challenges in today’s wealth management landscape. Commoditization of services – driven by fee compression, standardized model portfolios, and the rise of low-cost digital platforms – has made it harder than ever to stand out. At the same time, market volatility and uncertainty in recent years have exposed the limits of traditional portfolios. In this context, alternative investments (“alts”) are emerging as a crucial tool for advisors. By integrating alternative asset classes into client portfolios, RIAs can differentiate their offerings, deliver improved risk-adjusted returns, and enhance their firm’s enterprise value. This whitepaper examines the case for alternatives in wealth management, including their role in expanding the efficient frontier, capturing liquidity/complexity premiums, and ultimately helping advisors thrive in a competitive industry.

Expanding the Efficient Frontier with New Asset Classes

Modern portfolio theory teaches that adding assets with differing returns and risk profiles can improve a portfolio’s overall risk-return tradeoff. Historically, the efficient frontier – the set of optimal portfolios maximizing return for each level of risk – was constructed from traditional stocks, bonds, and cash. Over time, however, the investable universe has broadened dramatically. New asset classes such as private equity, venture capital, real estate, infrastructure, hedge funds, private credit, and others have expanded the efficient frontier, enabling investors to potentially earn higher returns for a given level of volatility (or reduce volatility for a target return) by including these alternatives.

Figure: Efficient Frontier for a traditional stock/bond portfolio (blue curve) versus a portfolio that includes an allocation to alternatives (gold curve). The inclusion of alternative assets pushes the frontier outward – at each level of volatility (risk), the portfolio with alternatives can achieve a higher expected return. In this illustrative example, adding alternatives raises the potential return from ~7% to ~9% at ~10% volatility, demonstrating how new asset classes expand the investment opportunity set.

In practical terms, introducing alternatives can improve portfolio diversification because many alts have low or modest correlation with public markets. For instance, real estate or infrastructure may respond to different economic drivers than equities, and private credit or hedge fund strategies can perform well in environments when publicly traded assets falter. By combining such assets with stocks and bonds, advisors can construct portfolios that lie above the traditional 60/40 frontier, achieving superior Sharpe ratios. Numerous studies have shown that portfolios including alternatives have delivered enhanced risk-adjusted returns over long periods. Institutions like endowments and pensions embraced this approach decades ago – the famous “endowment model” (pioneered by Yale) allocated heavily to alternatives and significantly outperformed a 60/40 mix over the long run. Today, independent advisors can follow suit on behalf of individual clients, moving portfolios beyond the constraints of traditional asset classes. The efficient frontier in 2025 is far higher and broader than it was in Markowitz’s 1950s framework, thanks to the addition of these alternative investments.

The Liquidity and Complexity Premium: Superior Risk-Adjusted Returns

Why do alternatives have the potential to boost risk-adjusted returns? A core reason is that private and complex assets often carry a liquidity premium (or complexity premium) – investors demand higher returns for investments that are illiquid, opaque, or operationally complex. In other words, because an investor’s capital may be locked up for years in a private fund (illiquidity) or because specialized expertise is required to underwrite a deal (complexity), the asset must offer extra compensation in the form of higher expected returns. Over time, this has translated into outperformance of many alternative asset classes relative to public markets on a risk-adjusted basis.

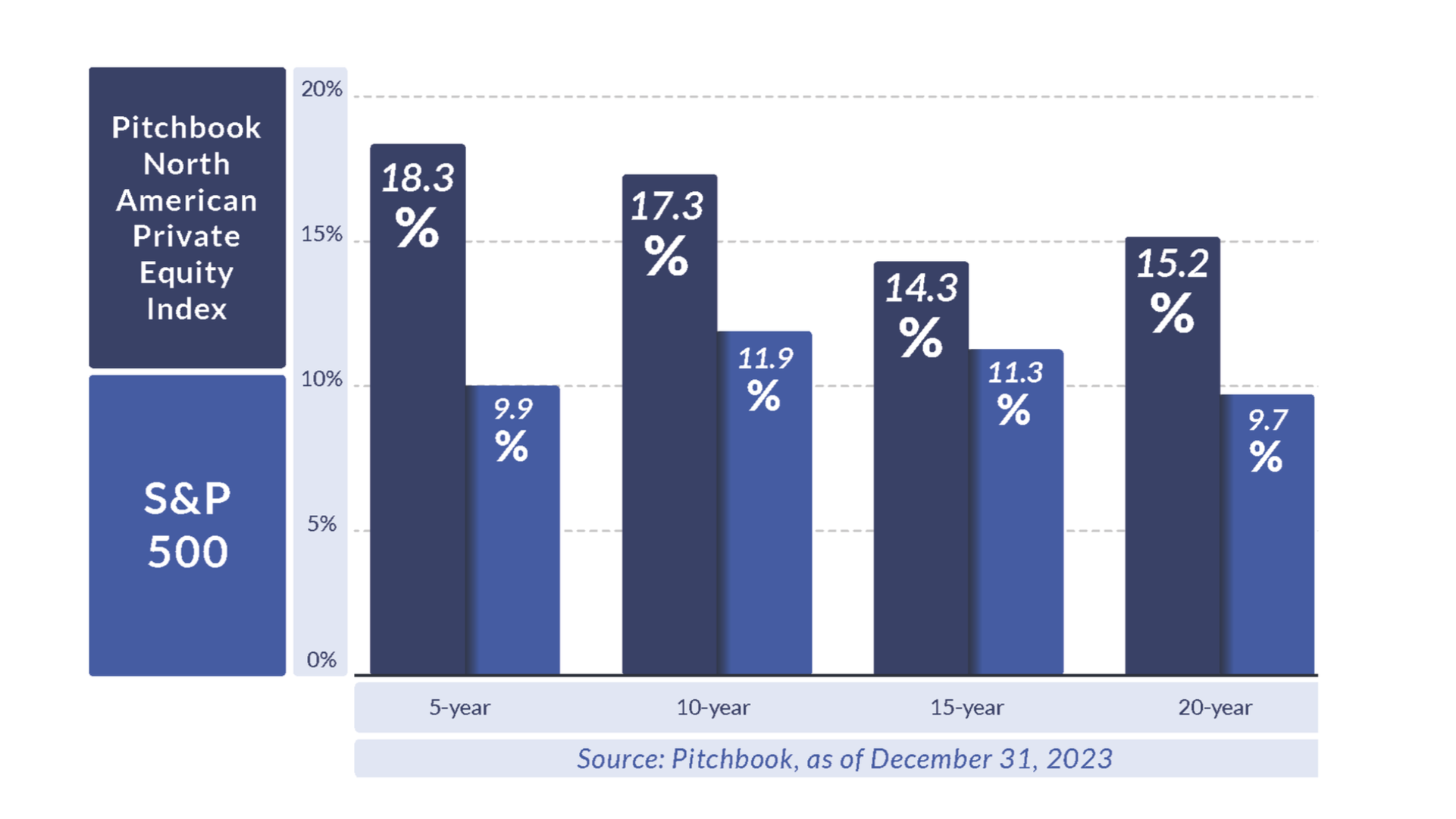

Empirical data bear this out. For example, private equity funds have historically generated higher long-term returns than public equity indices. One analysis notes that private equity has achieved risk-adjusted returns exceeding those possible in the public equity markets (Private equity - Wikipedia). Indeed, across multiple decades, broad private equity indices have outperformed the S&P 500 by several percentage points annually (even after fees), while exhibiting lower measured volatility (partly due to smoother valuations). This is evidence of an illiquidity premium accruing to long-term investors.

Similarly, private credit (direct lending) typically yields more than comparable public corporate bonds – middle-market private loans might yield, say, 8-10% where liquid high-grade bonds yield much less – compensating investors for liquidity constraints and bespoke underwriting. Real estate and infrastructure investments often provide steady income and total returns competitive with equities but with lower correlation and volatility, thus improving portfolio Sharpe ratios. Even hedge funds, which often involve complex trading strategies, have delivered diversifying return streams; certain strategies (e.g. global macro or market-neutral funds) have shown higher risk-adjusted returns than long-only equity, albeit with wide dispersion among managers.

It is important to note that not all alternatives automatically outperform, and there is considerable variance. However, the opportunity for superior riskadjusted performance is a defining characteristic of alternatives. Investors with long-term horizons and less need for immediate liquidity – which describes many RIA clients like high-net-worth families and foundations – are well positioned to capture these premiums. By allocating a portion of portfolios to illiquid and complex assets, advisors aim to harvest these additional returns, enhancing overall portfolio outcomes. In essence, alternatives allow access to unique return drivers (private market growth, skill-based alpha, real asset cash flows) that can richly reward patience and expertise.

Commoditization of RIAs and the Need for Differentiation

Wealth management has increasingly become commoditized. Fee compression is squeezing margins – for example, a 2018 industry study found the average advisory fee charged by RIAs was about 0.95% of assets reflecting pressure on the traditional ~1% AUM fee. Basic portfolio management using the classic 60/40 stock-bond allocation is now widely available at low cost, and many firms offer similar financial planning services. This standardization makes it difficult for independent RIAs to articulate a unique value proposition. When every advisor is delivering similar asset allocations and planning advice, clients may gravitate towards the lowest-cost provider or larger brands, further eroding loyalty and pricing power.

To counteract these trends, RIAs must find ways to differentiate beyond the basics. Alternatives provide a compelling avenue to do so. Unlike generic stock and bond portfolios, alternative investments (such as private equity, private credit, hedge funds, real estate, etc.) are not commoditized – access often requires specialized expertise, networks, and due diligence that an advisor can uniquely provide. By curating quality alternative opportunities for clients, an RIA can offer a value-added service that is not easily replicated by robo-advisors or cookie-cutter models. This not only justifies advisory fees, but also strengthens client relationships. High-net-worth clients, in particular, increasingly expect access to institutional-grade investments; an advisor who can deliver on that expectation will stand out. Moreover, clients committing to illiquid alternative funds (often with multi-year lockups) are inherently more “locked in” with their advisor, improving client retention and lifetime value. In short, alternatives give independent advisors a powerful tool to combat commoditization – creating distinctive offerings, delivering enhanced value, and cementing loyalty.

Enterprise Value Uplift: How Alts Enhance an RIA’s Business Value

In addition to improving client portfolios, offering alternative investments can directly increase the enterprise value of an RIA firm. Buyers and investors tend to place higher valuations on wealth management businesses that demonstrate unique capabilities and diversified revenue streams. RIAs that incorporate illiquid/alternative products – especially through proprietary access or in-house funds – are often seen as more differentiated, growth-oriented enterprises, and can command higher EBITDA multiples in M&A transactions.

There are several reasons for this valuation premium. First, proprietary alternative offerings (such as an RIA’s own private fund or a bespoke alternatives platform) can generate additional fee revenue beyond the standard AUM fee. For example, an advisor who launches a private real estate fund for clients might earn asset management fees or performance fees from that vehicle. These revenue streams are typically uncorrelated with market levels (they may be based on committed capital or realized gains) and thus add stability and upside to the firm’s financials. Second, clients invested in illiquid funds are stickier – they are less likely to leave the firm, given the long-term nature of the investments and the logistical complexity of moving those assets. This increases the duration of the RIA’s client relationships and AUM, which is attractive to acquirers. Third, an RIA with established alternative investment infrastructure (due diligence team, legal/compliance framework for private offerings, etc.) has effectively built a higher barrier to entry against competitors. All these factors contribute to buyers willing to pay a premium for such firms.

Industry observers indeed note that alternative-focused RIAs trade at elevated multiples. While a typical independent RIA might sell for, hypothetically, ~6-8× EBITDA, firms with robust alternative investment platforms and proprietary products can see significantly higher multiples in practice. This reflects the market’s view that these firms have stronger growth prospects and more resilient client bases. Offering alternatives can even transform an RIA’s identity from a pure advisory practice to a hybrid “wealth manager/asset manager” model, which often warrants a higher valuation akin to boutique asset management firms. In summary, embracing alternatives is not just good for clients – it can directly boost the equity value of the advisory business itself, an important consideration for owners planning for future succession or sale.

Market Volatility and the Catalyst for Greater Alt Allocation

Recent volatility and uncertainty in public markets have further underscored the case for alternatives. The last few years provided a stress test for the traditional portfolio paradigm. In 2022, for example, both equities and bonds suffered steep losses simultaneously – the S&P 500 index dropped about 19% for the year (its worst annual decline since 2008) and the Bloomberg U.S. Aggregate Bond index also fell by double digits (its worst year on record). A classic 60/40 portfolio delivered one of its poorest performances in decades. Many investors were caught off-guard as the usual negative correlation between stocks and bonds broke down due to surging inflation and rising interest rates. This “everything down” scenario has prompted investors and advisors to seek diversification beyond the traditional asset classes.

Alternatives can act as a shock absorber and return enhancer in such turbulent periods. Some alternative strategies are designed to thrive in volatility – for instance, certain hedge funds (like global macro or managed futures funds) generated positive returns in 2022’s chaos even as both stocks and bonds fell. Private markets, while not immune to economic cycles, do not experience the day-to-day volatility of public markets; valuations are smoothed and based on fundamentals, which can help investors stay the course without the whiplash of market prices. Real assets like infrastructure or commodities-tied assets can hedge against inflation, which was a major concern in 2022. Private credit became especially attractive in the rising rate environment, as yields on private loans reset higher and banks pulled back lending (creating more opportunities for private lenders). In essence, the case for diversifying with alts becomes strongest when traditional assets are under strain.

Even in 2023-2025, uncertainty remains elevated – whether due to inflation’s trajectory, geopolitical risks, or the tail end of the pandemic’s economic impacts. Forward-looking return expectations for stocks and bonds (given high valuations and low starting yields, respectively) are modest in many forecasts. Investors and advisors are therefore looking to broaden their toolkits. This has been evidenced by rising allocations to alternatives among wealth management clients. For example, many advisory firms reported increasing client interest in private investments after the volatility of 2020 and 2022, and industry surveys indicate that a majority of financial advisors plan to boost alt allocations in the next few years to improve portfolio robustness. In short, the challenges of the current market environment are accelerating a trend that was already underway – the embrace of alternative investments as a core component of asset allocation. Rather than being a luxury or an afterthought, alts are becoming a necessity for those seeking true diversification and enhanced returns in the face of public market instability.

Channels for RIAs to Access Alternative Investments

Integrating alternative investments into a wealth management practice is more feasible today than ever before. RIAs have multiple channels to access alts, ranging from off-the-shelf products to bespoke fund launches. Advisors should choose the approach (or combination of approaches) that best fits their firm’s size, expertise, and client needs.

The primary channels include:

Public/Semi-Public Vehicles (BDCs, Interval Funds, Non-Traded REITs): A variety of registered alternative products exist that provide retail or semiliquid access to alternative strategies. Business Development Companies (BDCs), for instance, are closed-end investment companies that invest in private companies or loans and often trade on public exchanges. They offer high income (from lending to middle-market businesses) and are accessible to retail investors. Interval funds are another vehicle – structured as continuously offered closed-end funds, they hold illiquid assets (private credit, real estate, etc.) but allow periodic redemptions (e.g. quarterly). Interval funds provide a way for clients to invest in alternatives with some liquidity and regulatory oversight. It is important to be wary that in times of crisis; you may not be able to get your capital back in a timely manner. Nontraded REITs (real estate investment trusts that are not exchange-listed) are yet another example: these funds invest in portfolios of properties or real estate loans, offering diversification into real assets and typically a steady yield. They do not trade daily like publicly listed REITs, but investors can often redeem on a limited basis (subject to caps or blackout periods). These public/semi-public vehicles are distributed through custodians and broker-dealer networks, making them relatively easy for RIAs to implement. They come with built-in management teams and custodial arrangements, so the advisor’s role is to perform due diligence on the product and allocate appropriately in client portfolios. Such vehicles have exploded in popularity (for example, Blackstone’s non-traded REIT raised tens of billions in recent years), bridging the gap between retail capital and institutional-caliber alternative investments.

Alternative Investment Platforms (iCapital, CAIS, Fundrise / Fundviews, PPB, Glasfunds, etc.): In the past, access to private funds (e.g. a top-tier private equity or hedge fund) was limited to large institutions or ultrawealthy investors with multimillion-dollar minimums. Today, fintech platforms have democratized access, allowing independent advisors to tap into institutional funds at lower minimums and with streamlined administration. Platforms like iCapital Network and CAIS partner with leading fund managers across private equity, venture capital, private credit, real estate, and hedge funds, creating feeder funds or share classes that smaller investors can enter (often with minimums in the tens or hundreds of thousands, rather than millions). These platforms handle the operational heavy lifting – they aggregate RIA client subscriptions, conduct due diligence on fund managers, facilitate paperwork and compliance (accreditation checks, subscription documents), and often integrate with custodians for reporting. Other players such as PPB Capital Partners, Glide Capital (portfolios), Glasfunds, and Opto Investments, similarly provide curated menus of alternative funds to the RIA community. Other platforms such as Fundviews Capital, Glide Capital (hosting), and Outsourced COO / CFO firms provide the structure and operations, while letting the wealth manager focus on due diligence and sourcing of alts. By using a platform, an advisor can plug-and-play into a wide selection of vetted alternative funds, or operational capabilities – essentially outsourcing the product sourcing and admin. This drastically lowers the barrier to entry for offering alts. An RIA can allocate client assets to, say, a private equity fund or an interval fund on these platforms almost as easily as buying a mutual fund, while the platform ensures all regulatory and operational details are handled. The trade-off is an additional platform fee or slightly higher expense ratios, but in exchange the advisor gains scale and access that would be hard to achieve alone. These platforms have become increasingly popular, and even large asset managers and banks have launched their own (for example, Goldman Sachs’ “GS Select” platform for alternatives). The platform route allows independent advisors to deliver institutional-quality alts to clients efficiently.

Launching Proprietary Funds and Vehicles: A more advanced route is for an RIA to create its own alternative investment vehicles for clients. This could range from setting up a simple special purpose vehicle (SPV) for a single private deal, to launching a commingled private fund (e.g. a private real estate fund or fund-of-funds) that the RIA manages. By doing so, the advisor can offer truly exclusive opportunities – deals or funds only available to their clients – and potentially capture additional economics (management fees, carried interest). However, this approach requires significant commitment to build the necessary legal, compliance, and operational infrastructure. The RIA must engage legal counsel to draft offering documents (PPMs, LLC agreements), ensure compliance with securities exemptions (Reg D filings for accredited investor offerings, etc.), set up fund administration and custody for the vehicle, and have the expertise to source and manage the underlying investments. In essence, the firm takes on the role of a GP/asset manager in addition to advisor. Many larger family offices and RIAs have successfully done this – for example, launching proprietary private equity co-investment funds or real estate partnerships for their clients. The benefits are compelling: the firm can tailor the strategy to client needs, potentially offer lower fees than third-party funds, and strengthen the firm’s brand as an investment originator rather than just allocator. It also deepens client engagement (investors feel they are part of something unique run by their advisor). Still, it’s not a step to be taken lightly; firms that go this route often start by hiring or partnering with experienced alternatives professionals or outsourcing portions of the process (e.g. using third-party fund administrators or turnkey fund setup services). For RIAs that reach sufficient scale and expertise, proprietary products can be the capstone of an alternatives strategy – offering maximum differentiation and economic benefit.

In practice, many advisory firms will use a combination of these channels. For example, an RIA might utilize an alternative platform for core private fund allocations, supplement with some interval funds or BDCs for semi-liquid exposure, and eventually develop a niche proprietary fund for a strategy where they have unique insight. The key point is that accessing alternatives is no longer reserved for the largest institutions – even modest-sized RIAs have many tools at their disposal to integrate alts into client portfolios in a controlled, compliant way.

CONCLUSION

The wealth management industry is at an inflection point. As traditional offerings become commoditized and market dynamics call into question long-held portfolio assumptions, independent RIAs and family offices must innovate to thrive. Embracing alternative investments provides a powerful answer to these challenges. Alternatives enable advisors to differentiate their services, offering clients opportunities and outcomes beyond what a simple stock/bond mix can achieve. They allow portfolios to access a wider efficient frontier, capture illiquidity premiums for long-term benefit, and mitigate the risks of public market volatility. Furthermore, by integrating alternatives – whether through third-party platforms, specialized funds, or proprietary products – advisors can elevate the value of their own enterprises, positioning their firms as forward-thinking and resilient in the marketplace.

It’s important to recognize that incorporating alternatives is no longer an overwhelming hurdle. There are multiple accessible paths: from userfriendly feeder platforms to interval funds to creating an in-house fund with the help of outsourced experts. Advisors can start incrementally, building knowledge and comfort over time. The most critical step is to get started – to begin educating clients (and staff) on the role of alternatives, to perform due diligence on available offerings, and to make thoughtful initial allocations. Those advisors who develop competency in alternatives will be able to offer a more compelling value proposition – one that addresses clients’ evolving needs for higher returns, lower correlation, and bespoke opportunities. In contrast, advisors who ignore this movement risk falling behind competitively and delivering subpar outcomes in a world beyond the 60/40 paradigm.

In conclusion, the message is clear: alternative investments are no longer “alternative” – they are essential. For independent RIAs and small family offices, integrating alts is not just an investment decision but a strategic business decision. By embracing alternatives, advisors can better serve their clients and secure their own future in an increasingly challenging wealth management landscape. The case for alternative investments in wealth management rests on a simple idea – to truly excel and endure, advisors must expand their horizons, and there is a rich world of opportunities waiting beyond the traditional asset classes.

Greg Poapst

Managing Partner

Fundviews Capital

Fundviews Capital works with asset managers and business operators with in-depth knowledge and expertise in specific asset classes and want to take their business to the next level. Fundviews provides institutional fund structuring and back-office solutions for our partners, allowing them to focus on doing what they do best; asset management. This cohesive relationship creates the perfect environment to scale business to a whole new level.