Specialist Direct: A Modern Family Office Strategy for Venture Investing

By Paul Palmieri & Grant Nelick

Over the last decade, the family office landscape has undergone a quiet but profound transformation. What was once a niche corner of the wealth management world, dominated by multi-generational families and opaque structures, has grown into a highly active, sophisticated segment of the private capital ecosystem. The rise of first- and second-generation entrepreneurial wealth has redefined both the mindset and the mandate of many modern family offices. These families are not merely seeking capital preservation; they are looking for control, alignment, and participation in value creation. Nowhere is this more evident than in the growing appetite for direct investments.

Today, direct private investing is no longer a fringe activity among family offices. According to UBS Family Office data, over 60% of family offices are actively pursuing direct deals, either independently or via co-investment partnerships. Much of this capital is being deployed into technology and innovation-driven sectors, where family principals often bring operating expertise, networks, or thematic conviction. But while the desire for direct exposure is clear, the path to achieving it in a structured, repeatable way is less so.

At the same time, many advisors to family offices continue to rely on institutional playbooks; most notably the Yale Endowment model popularized by David Swensen. That model, rooted in diversification across illiquid alternatives and exposure to mega-sized fund managers, has merit. But when applied in a subscale context (e.g., allocating $5M into a $2B flagship buyout or venture fund), it tends to underdeliver. The family office becomes just another small LP, without access, without influence, and often with limited visibility into underlying assets.

This paper proposes an alternative: a model we call Specialist Direct. Specialist Direct is a strategy purpose-built for family offices with a desire for direct investment exposure but face structural constraints such as subscale check sizes, limited access and negotiating leverage, fee drag, and thin governance. Rather than spreading capital across large blind pools or pursuing fully independent direct deals, Specialist Direct involves anchoring a small number of specialist venture capital managers, particularly those raising sub-$150M funds with a focus on seed-stage or early growth investing.

For clarity, in this paper, “specialist” refers to a venture manager investing within a deliberately bounded mandate where they hold specific knowledge and a repeatable edge, typically by sector (e.g., fintech, health, consumer goods), technology domain (biotech, robotics, cybersecurity), or business model (vertical SaaS, infrastructure, marketplaces). We use “specialist,” “sector-specific,” and “thematic” interchangeably throughout. The key lever is that specialization turns domain knowledge such as customers, training datasets, biomarkers, and sales channels, into advantages in access, underwriting/selection, and post-close value-creation, ultimately improving risk-adjusted returns.

The anchor position is the core lever in this model. By making a meaningful early commitment (often $5–15M), the family office gains not only improved economics and governance visibility, but also a prioritized pipeline of co-investment opportunities. These specialist managers effectively become a “farm team” for later-stage direct exposure, offering opportunities where the family office already has visibility, context, and preexisting trust in the GP’s underwriting and conviction.

Co-investments often pull liquidity forward by concentrating capital in later-stage, validated companies with nearer-term milestones and clearer exit paths. In addition, their low/zero-fee terms lower blended fees on deployed capital. The result is typically IRR accretive deployment, and with disciplined entry and pricing, higher net returns.

The strategy is repeatable. By backing four to five funds per deployment cycle that are aligned with verticals where the family has operating knowledge or informed conviction, the family office constructs a thematic, co-investment-enabled portfolio. Importantly, this structure offers a middle path between the scale and access barriers of traditional fund investing and the resourcing burdens of sourcing, conducting diligence on, and managing direct deals independently.

The long-term payoff is twofold: better-aligned exposure to high-growth companies, and a dynamic pipeline of direct opportunities with risk-adjusted entry points. When executed with rigor, Specialist Direct offers a way to build a differentiated private markets portfolio that reflects the DNA of the family office itself: entrepreneurial, engaged, and unconstrained by institutional convention.

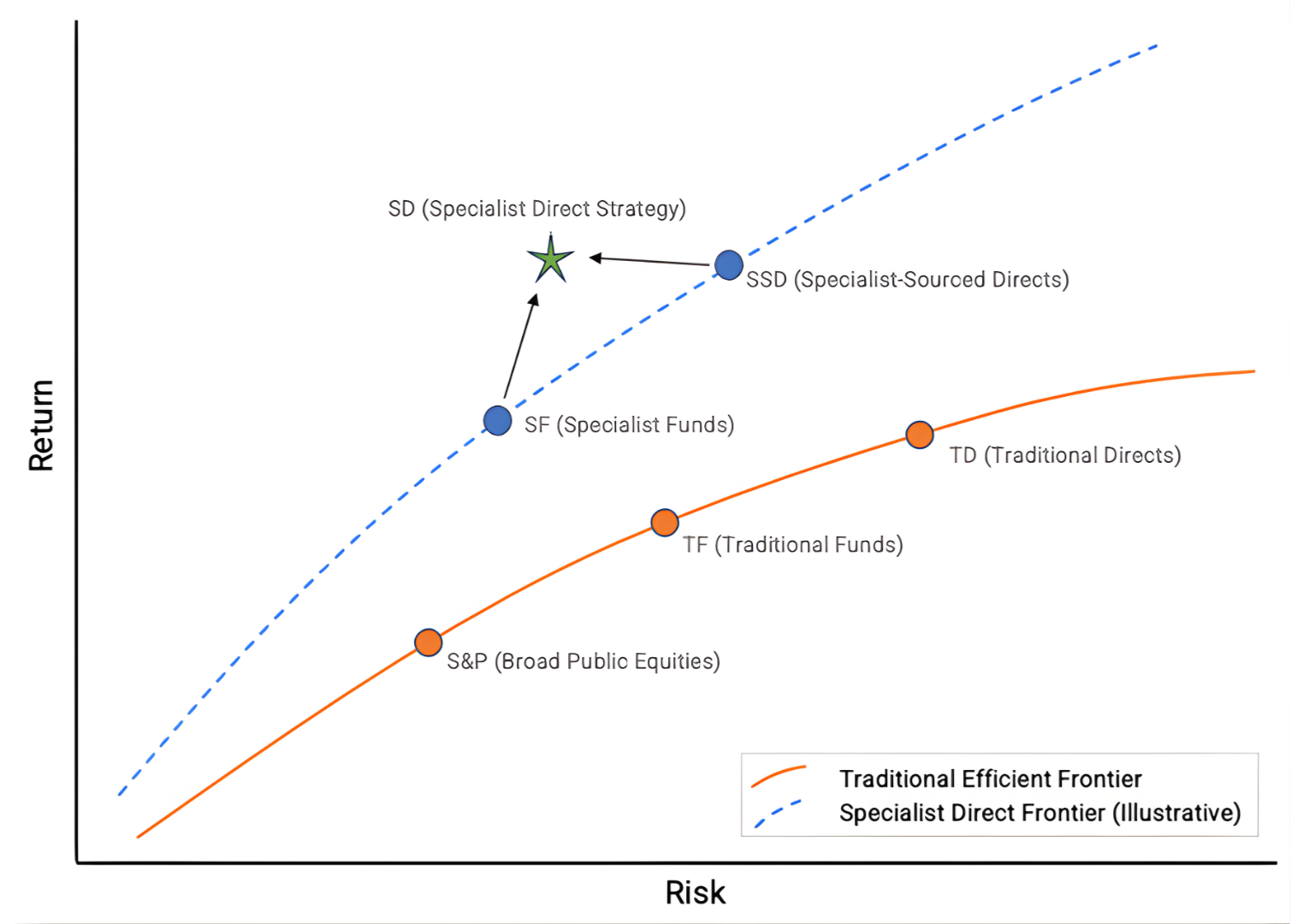

By blending anchor fund commitments with selective co-investments, Specialist Direct creates an asymmetric return profile. Funds provide breadth and access, while co-investments concentrate into idiosyncratic winners, together moving the Specialist Direct sleeve beyond a traditional mean-variance efficient frontier. The figure below is illustrative of this, not to scale.

The full paper outlines the case for this approach, presents a simulated portfolio model, and provides practical guidance on sourcing, structuring, governance, and risk. It is not a fund pitch, but a framework designed to help family offices compete where their structural advantages are strongest.

Why the Yale Model Doesn’t Translate for Family Offices

Since its popularization in the early 2000s, the Yale Endowment Model has become a touchstone for institutional portfolio construction. Created under the leadership of David Swensen, Yale’s approach emphasized diversification across illiquid alternatives, which include private equity, venture capital, hedge funds, and real assets, while minimizing public equities and fixed income. It was a radical departure from the traditional 60/40 model and, for large-scale endowments and sovereign wealth funds, it has delivered strong long-term results.

However, over the past 15 years, the Yale model has been enthusiastically adopted by smaller institutions and family offices often without fully considering the underlying conditions that made it successful in the first place. This has led to what we might call “subscale Swensenism”: a structurally mismatched attempt to replicate Yale's allocation logic with a fraction of its capital, access, and negotiating power.

The result is a portfolio that carries the appearance of sophistication - alternative-heavy, manager-diversified, illiquid by design - but underperforms on the dimensions that matter most to family offices: access, influence, and alignment with values and knowledge.

At its core, the Yale approach depends on institutional scale, and not just in terms of asset size, but in the strategic leverage that comes with it. With billions in AUM and multi-decade relationships, Yale secures access to brand-name managers on preferred terms. It commits early, negotiates fees, and often takes anchor or strategic LP roles. Its capital matters to the GPs it invests with.

For a family office allocating $5–10M per manager, this dynamic rarely holds. Even if they gain access to the same set of funds, they typically enter late in the fundraising cycle, with standard economics and limited visibility. As a result, they become just another line item on a GP’s cap table, often without co-investment rights, governance participation, or even consistent reporting.

The Yale model’s performance is not just a function of asset allocation; it’s a function of asymmetric access. That access does not scale down. Specialist Direct addresses this scale constraint.

The Rise of Specialist GPs and Micro Funds

In an industry often preoccupied with platform scale, the most important transformation in private markets over the last decade has happened in the opposite direction: the emergence and performance of specialist GPs and micro funds. These are vehicles typically under $150 million in size, tightly focused on a sector, technology domain, or business model. Their edge lies not in breadth, but in depth , and increasingly, in lived experience. Together with the rise of emerging managers, this forms a “triple threat”: smaller fund sizes, specialists over generalists, and emerging over established - three dynamics with persistent outperformance signals.

The Data Behind the Trend

According to PitchBook, sub-$150M funds represented nearly 40% of all U.S. venture funds closed in 2023. First- and second-time managers, many of them launching spin-outs from larger firms or building around their own founder networks, doubled in number from 2020 to 2022.

StepStone’s 2023 “Emerging Manager Outlook” reported that early vintage specialist funds delivered 250–350 basis points of excess IRR relative to large platform funds in comparable vintages. Additionally, their 2022 “The Alpha Algorithm for Micro VC Managers” reported a 2.8x TVPI upper quartile threshold for micro-VC funds, compared to a 2.1x for funds over $200M in size.

What explains this outperformance? Micro funds are structurally disciplined. They focus on earlier-stage entry points, smaller check sizes, low reserve ratios, and more diverse time-to-liquidity paths. They target meaningful ownership (10–20%) in high-conviction companies, rather than indexing across dozens of names. Smaller funds are better able to, and have historically achieved outsized multiples because, with lower valuations and meaningful ownership, a single large win can return the fund (and more). Their sourcing pipelines are often founder-driven and not reliant on intermediaries, bankers, or demo day access.

The Strategic Fit for Family Offices

Family offices, particularly those built on operating company success, are thematically driven. They prefer investing in sectors they know, understand, or believe will define the next economic cycle. Unlike institutional LPs, who often seek generalized exposure across asset classes, families can lean into their convictions, and specialist GPs allow them to do exactly that.

The Specialist Direct Strategy

As family offices grow more sophisticated and expand their appetite for private markets, a clear need has emerged: a middle ground between passively allocating to funds and fully building out a direct investment team.

Enter Specialist Direct: a strategy designed to give family offices influence, access, and alignment without requiring them to become institutional private equity firms themselves. It is not a product, nor a fund-of-funds. It is a deployment strategy, leveraging a family office’s capital, thematic focus, and relational capacity to build a portfolio of high-conviction, high-alignment private investments.

At its core, Specialist Direct is about working smarter with the advantages family offices already have: speed, flexibility, and operating knowledge. And it does this by anchoring specialist venture managers with micro-funds, not just writing checks, but shaping outcomes.

Strategy Overview

The Specialist Direct strategy has five key components:

Anchor 4–5 Specialist GPs per Deployment Cycle

Identify sub-$150M specialist funds aligned to the family’s domain, with lower reserves and co-invest/syndication policies that enable LP allocations.Take a Meaningful Position as an Anchor LP

This means committing $5–15M, often 10–20% of the total fund size, which positions the family as a strategic partner, not a passive investor.Negotiate Governance and Access Rights

Including LPAC participation, reporting enhancements, and most critically, co-investment rights.Build a Co-Investment Sleeve with Selective Deployment

Create a co-invest pool of capital (typically 30% of the total strategy) to deploy into later-stage rounds of portfolio companies surfaced by anchored GPs.Recycle and Recalibrate Each Cycle

Evaluate each deployment cycle, recycling capital into new managers or vintages while retaining successful GP relationships.

The result is a portfolio that blends fund exposure with direct investing economics without requiring the family office to source or lead deals from scratch.

Why Anchoring Works

Anchoring is about more than being the first check in. It changes the relationship. When a family office anchors a fund, especially a first- or second-time GP, it typically unlocks: preferred economics (fee or carry reductions), governance visibility (LPAC or informal advisory access), co-investment rights (rights of first refusal, pre-negotiated economics), and possibly most importantly, relationship equity (founder introductions, shared diligence, strategic dialogue).

This isn’t theoretical. In a 2023 StepStone survey, 68% of sub-$150M GPs reported offering co-investment rights or governance access to anchor LPs. In the same study, 72% of family offices said anchor positions had materially increased their visibility and influence in fund strategy and deal flow. Anchoring creates mutual dependence. The GP gets credibility and momentum; the family office gets access and alignment.

Specialist Direct Scales for Family Offices of All Sizes

Specialist Direct is a practical way to modernize venture exposure for family offices with AUM from roughly $50M to $2B+. Smaller mandates can right-size by anchoring fewer managers or targeting smaller specialist funds, so a modest commitment still represents a meaningful share of the vehicle. They can also co-anchor with one or two aligned families to reach rights-bearing size. Alternatively, a multi-family office (MFO) syndication can pool commitments to create an anchor-scale position. Both approaches preserve the model’s benefits, including access, improved economics, and co-invest priority, while requiring fewer resources.

As families grow, the strategy scales by adding managers across non-overlapping sectors, opening additional syndication lanes, and standardizing co-invest SPVs, without abandoning the anchor-first discipline. Families can also increase check sizes/anchor percentages with existing GPs or target funds at the upper end of the specialist range.

Why We Wrote the Specialist Direct Strategy

At Grit Capital Partners, we’re not intermediaries. We’re not consultants. We’re not productizing a fund of funds. We’re operators turned investors - and we wrote this because we believe family offices deserve a better path to private market alpha.

We’ve spent years in the trenches, and we’ve seen firsthand how wealth creators - especially those from the current or prior generation - bring deep value to the innovation economy. But we also see a market increasingly flooded with new service providers, platforms, and secondary aggregators all chasing the same thing: pro-rata rights, deal scraps, and yield. Too often, value that should accrue to families instead gets siphoned off by gatekeepers.

So we wrote the Specialist Direct strategy as a different model. One rooted in respect for what families have built, and aligned with where we believe outsized returns will be created over the next decade - in AI, robotics, stablecoins, biotech, and beyond.

This framework is designed to scale up and down. It contemplates different family sizes, governance models, and degrees of experience. But the through-line is simple: anchor specialist funds run by founder/CEOs, stay close to the innovation, and lean in when conviction is earned.

We’re grateful to the allocators, analysts, and partners who helped us sharpen the simulations behind this. And we offer it not as a sales pitch - but as a playbook for families who want to participate, not spectate.

To access the full paper, strategy, simulations, governance and risk considerations and overall framework go to http://www.grit.vc/specialist-direct.

Paul Palmieri

Managing Partner

Grit Capital Partners

Grant Nelick

Senior Associate

Grit Capital Partners

Grit Capital Partners is a NY based, seed stage venture firm exclusively focused on the Applied Layer of AI transforming Fintech, Martech, Commerce and Media. The investing partners have generated nearly $2 billion in enterprise value as founder CEOs of defining companies in these sectors, and are thought leaders in these industries. After deliberate and careful cultivation of the Firm’s investment strategy across two top-decile-performing pilot funds, Grit has scheduled its final close of its 75M Fund 3 for Q1 2026. GRIT provides a highly select group of Limited Partners access to its differentiated sourcing, diligence, and value creation capabilities during a time of massive opportunity in the innovation cycle. The team takes a concentrated approach to portfolio construction and serves as a close, trusted partner to entrepreneurs post-investment, leveraging deep industry expertise, hard-learned operating acumen, and a vast network of influential leaders within its target markets to cultivate the next generation of applied AI founders. Grit programmatically provides co-invest opportunities in the spirit of building a next-generation blended-value relationship between manager and allocator.