SEC Custody Rule: Two Paths to Compliance

By Inspira Financial

With growth comes responsibility. When a private fund advisor’s assets under management exceed $150 million, they are required to register with the SEC and become subject to the Investment Advisers Act, including the Custody Rule. For advisors to pooled investment vehicles holding non-transferable privately offered securities, there are two paths to compliance with a key requirement of the rule—managers of pooled investment vehicles holding such securities must either:

Place assets with a qualified custodian and submit to an annual surprise examination; or

Undergo an annual financial audit annually.

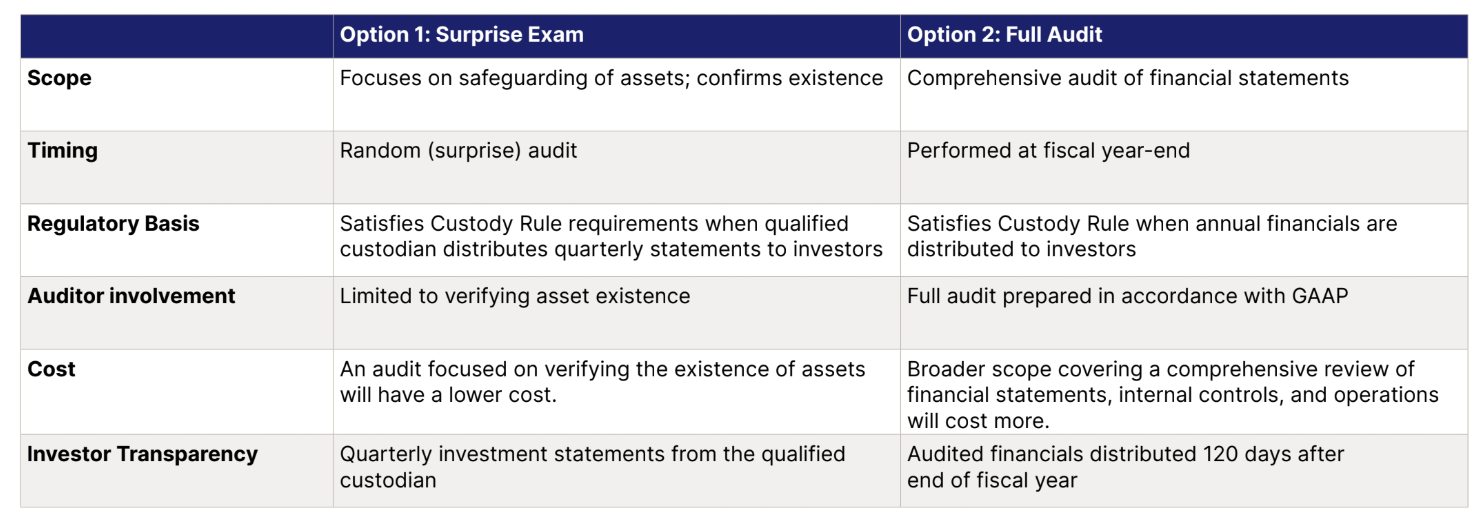

Both the surprise examination and the full audit must be conducted by a PCAOB-registered independent public accountant but with a different scope.

OPTION 1 Qualified Custodian and Surprise Examination

The first option allows managers to forego a full, distributed audit and instead elect to use a qualified custodian to hold client assets and to submit to a surprise examination annually. As noted in its name, the surprise exam is an unannounced inspection conducted at random times chosen by the accounting firm. The purpose of the surprise examination is to verify that the advisor is safeguarding client assets as required by the Custody Rule.

This tends to be a more cost-effective and less burdensome solution. Rather than a complete financial statement audit, it focuses on verification of assets. The accountant selects a sample of the advisor’s records to reconcile with those of its clients and custodians to verify assets’ existence and activity. The report will identify the procedures performed and express an opinion on management’s compliance with the requirements.

This option is often preferred because it limits the disruption of business operations and is less expensive than a full audit. In addition, investors receive more immediate transparency from quarterly fund statements than from annual audit reports delivered well after the end of the fiscal year.

Key requirements of this option include:

Assets must be in the custody of a qualified custodian.

The custodian must distribute quarterly fund statements to investors. These statements report on fund holdings and may include: valuations, transactions, and cash flows.

If material discrepancies are found, the accountant must notify the SEC within one business day.

OPTION 2 Annual Financial Audit

The second option involves undergoing a full annual financial audit prepared in accordance with U.S. GAAP, that is then distributed to all investors. This approach provides an independent verification of the fund’s financial condition and operational integrity. However, a full annual fund audit may cost more than the use of a qualified custodian in connection with a surprise exam.

To comply with the Custody Rule under this option:

The audit must be performed on a consolidated basis, encompassing the fund and all subsidiary entities.

Audited financials must be distributed to all investors within 120 days of the fund’s fiscal year-end.

The audit must cover a complete set of financial statements, including the balance sheet, statement of operations, cash flows, and changes in partners’ or members’ capital.

Choosing the Right Option

Both compliance paths meet the requirements of the SEC Custody Rule, which is fundamentally designed to safeguard client assets from misappropriation and misuse, and to promote transparency. Fund managers should evaluate both options carefully to determine which approach best aligns with their fund structure, investor expectations, and long-term compliance strategy.

This material is presented for informational purposes only and such information is believed to be accurate as of the publication date; however, it is subject to change. Inspira Financial Trust, LLC and its affiliates perform the duties of a directed custodian and/or an administrator of consumer directed benefits and, as such, do not provide due diligence to third parties on prospective investments, platforms, sponsors, or service providers, and do not offer or sell investments or provide investment, tax, or legal advice.

©2025 Inspira Financial Trust, LLC. All Rights Reserved. Inspira Financial Trust, LLC and its affiliates perform the duties of a directed custodian and/or an administrator of consumer directed benefits and, as such, do not provide due diligence to third parties on prospective investments, platforms, sponsors, or service providers, and do not offer or sell investments or provide investment, tax, or legal advice.

Inspira and Inspira Financial are registered trademarks of Inspira Financial Trust, LLC. Inspira Financial Trust, LLC does business as Inspira Associates, LLC in Nevada, Washington, Virginia, California, Michigan, and Arizona.

WB-160 (10/25) | ©2025 Inspira Financial. All rights reserved.

Matt Kiggins

Senior Sales Executive,

Regional Director Custody Services

Inspira Financial

Ryan Schneider

SVP, Regional Director -

Alternative Solutions Group

Inspira Financial

Inspira Financial is your devoted health, wealth, retirement, and benefits administrator. We work with organizations and individuals to navigate paths towards a better future and turn everyday actions into life-changing impact.

We believe that together, we have the power to enrich lives. We take on the incremental, the complex, and the time-consuming—providing solutions that strengthen and simplify the health and wealth journey.

Inspira Financial is the brand name used for products and services provided by one or more of the Inspira Financial group of companies, including Inspira Financial Trust, LLC (formerly known as Millennium Trust Company, LLC) and Inspira Financial Health, Inc. (formerly known as PayFlex Systems USA, Inc.).

Retirement and custody services are provided by Inspira Financial Trust, LLC and consumer directed benefits are administered by Inspira Financial Health, Inc. Inspira Financial Trust, LLC and Inspira Financial Health, Inc. are affiliates. Inspira Financial Trust, LLC and its affiliates perform the duties of a directed custodian and/or an administrator of consumer directed benefits and, as such, do not provide due diligence to third parties on prospective investments, platforms, sponsors, or service providers, and do not offer or sell investments or provide investment, tax, or legal advice. Inspira and Inspira Financial are trademarks of Inspira Financial Trust, LLC.