Private Equity Investments and the J-Curve

By Fred Ruffy

The J-curve is based on the observation that private equity investments typically have negative cash flows in the early years before seeing gains in later years as investments mature and exits generate returns. Here’s why it matters.

In private equity, the J-curve describes the tendency for investments to show negative returns in initial years and then show increasingly positive returns as the investments grow and mature. This means that early investors must often experience unfavorable returns until a gradual recovery, a return to the starting point, and (ideally) growth beyond the initial investment.

The J-curve underscores the need for patience, as private equity investments often come with long lock-up periods and limited liquidity, preventing investors from accessing their capital in the early years. The upshot is the potential for added diversification and above-market returns in later years as successful private investments can potentially experience exponential growth.

What is private equity?

Private equity investments generally involve pooling capital into funds that acquire, manage, and eventually exit private companies with the goal of generating significant returns. Often structured as funds (venture capital, buyout funds, or fund of funds), investments can span a wide range of industries, including technology, retail, real estate, energy, infrastructure, healthcare and biotech.

Unlike publicly traded securities, which can be bought and sold freely, private equity investments typically require a long-term commitment, sometimes a decade or more. During this time, fees, underperforming early investments, and the slow deployment of capital can contribute to negative returns before portfolio companies mature and generate meaningful gains.

Sizing up the J-curve

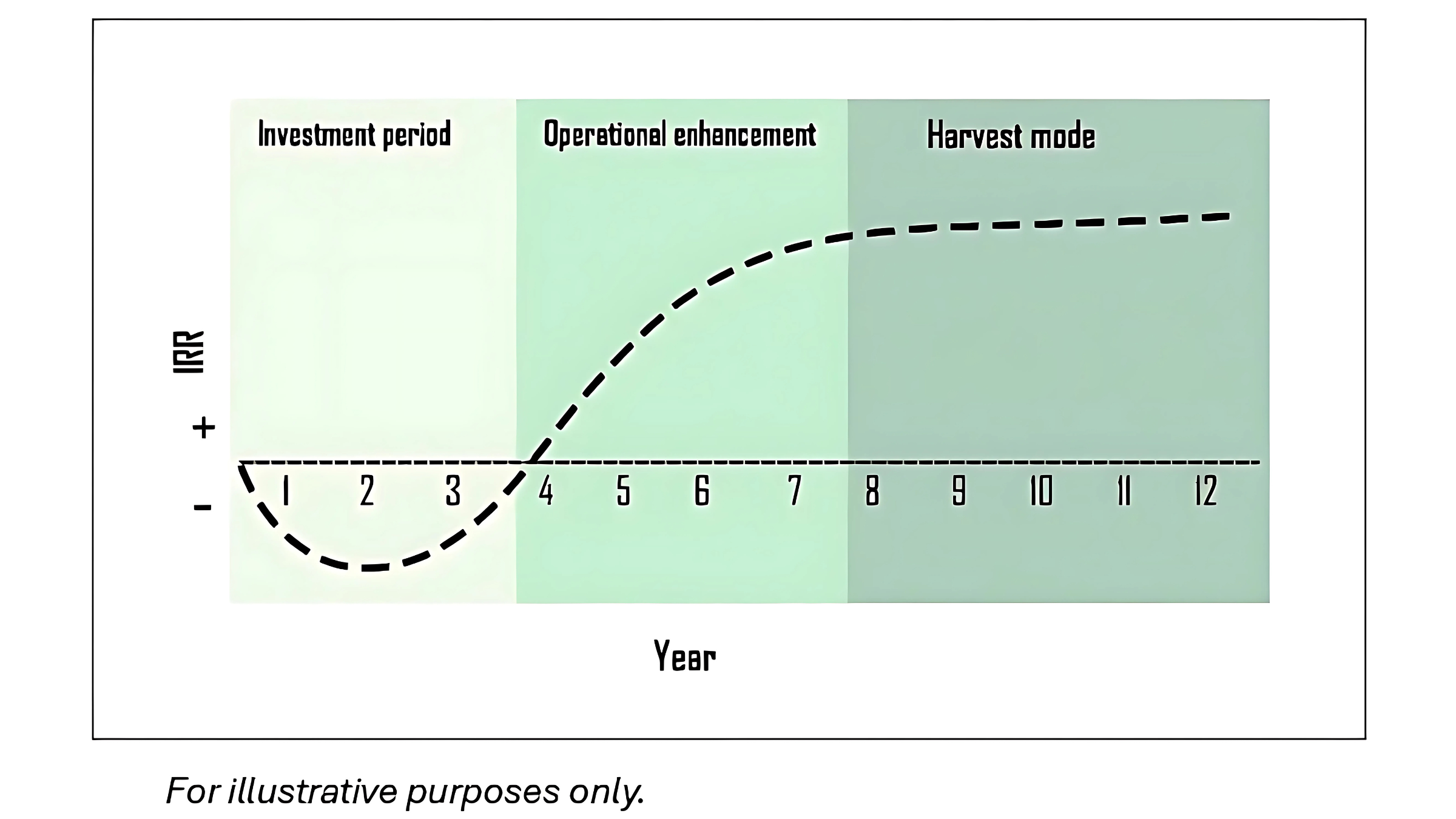

Private equity funds typically follow a J-curve return pattern, often starting with negative returns due to early costs and premiums paid for acquisitions. Over time, as portfolio companies grow, net asset value (NAV) increases, with returns materializing during exit events, typically after three to eight years. The J-curve concept in private equity originated from economists and investment analysts studying the cash flow patterns of private equity funds, and it gained prominence in the 1980s and 1990s as the industry matured. It gets its name from the shape of line for the typical internal rate of return (IRR) over time.

While no two investments are exactly alike, it can help to break the J-curve down into three distinct phases. During the investment period, typically the first few years, the fund deploys capital into portfolio companies, incurring fees and expenses that often result in negative early returns.

The operational enhancement phase follows and represents the time when fund managers work to improve the financial and operational performance of the investments, aiming to increase their value. Finally, in harvest mode, the fund exits investments through sales, IPOs, or other liquidity events, realizing gains and generating returns for investors.

Long-term value creation

Companies that receive capital from private equity funds are often privately held for several years, meaning they lack an observable market price. Unlike publicly traded stocks, with values that fluctuate and are published throughout the trading day, private equity investments generally require a long-time horizon to determine their fair market value. This also means that private equity investments are less susceptible to the whims of market sentiment, high-frequency traders, and the hot money flows that cause volatility in the secondary markets.

Also, during the early stages, private equity firms actively work to enhance the companies they invest in—whether through operational enhancements, strategic restructuring, or expanding market reach. Because these transformations take time to materialize, funds may initially report holdings at cost before any measurable value appreciation occurs.

As a result, early-stage performance data can be misleading, especially for younger funds still in the steepest part of the J-curve. The initial losses—driven by management fees, uninvested capital, and early underperformance—may give an overly negative impression of a fund’s long-term potential.

Takeaway

For investors with long-term perspectives and time horizons, private equity offers the potential for significant value creation as portfolio companies mature and exit strategies, such as IPOs or acquisitions, generate returns. However, the J-curve is a reminder that private equity investors should be prepared for an initial dip in investment returns in the early years, understanding that private equity requires patience, a longer-term time horizon, and (in some cases) a tolerance for illiquidity. Unlike publicly traded stocks, these investments aren’t easily bought and sold through mainstream brokers, and their value may take years to materialize.

Meanwhile, the benefits to private equity investments are added diversification and the potential for enhanced returns. At Regiment Securities, we’re vetting new opportunities that strike the best balance between risk and reward in today’s vast private equity market. New offerings are in the pipeline that are being structured to offer access to private markets and liquidity. Contact us to discuss the types of investments that can potentially play a role in your portfolio.

Disclosures and Disclaimers

Past performance may not be indicative of future results.

Diversification and asset allocation do not ensure a profit or protect against a loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio.

This document has been prepared to provide background information only. This document does not constitute an offer or invitation to subscribe or purchase any securities. An invitation to invest will only be made on the distribution of a final private placement memorandum and subscription agreement to duly qualified recipients, following applicable registrations and other securities law requirements. A full description of the investment terms and strategies (and related risk factors) of the offering will be outlined in the above-referenced documents. In the case of any inconsistency between the descriptions or terms in this marketing document and the above referenced final offering documents, the offering documents shall control. Due to, among other things, the volatile nature of the markets and the investment strategies discussed herein, the investment strategies of this offering may only be suitable for certain investors. Parties should independently investigate any investment strategy or manager, and should consult with qualified investment, legal and tax professionals before making any investment.

Fred Ruffy

Independent Representative

Regiment Securities

Fred Ruffy is an independent rep with Regiment Securities, LLC, a Chicago-based investment bank focused on alternative and uncorrelated investments. He’s a veteran content strategist specializing in trading, capital markets, and alternative investments. Fred has worked with leading broker-dealers and investment firms to craft high-impact communications for retail and institutional audiences.